From Wirecard to the Adani Group, staying ahead of changing risk - both direct and indirect - has never been more important and more critical for financial crime, credit and business teams. The combination of global, high-velocity data and new technology helps unlock a better understanding of risk at the customer level, as well as customer's customers and other indirect relationships (the latter being an area where a significant amount of risk can be found but is rarely detected using standard approaches).

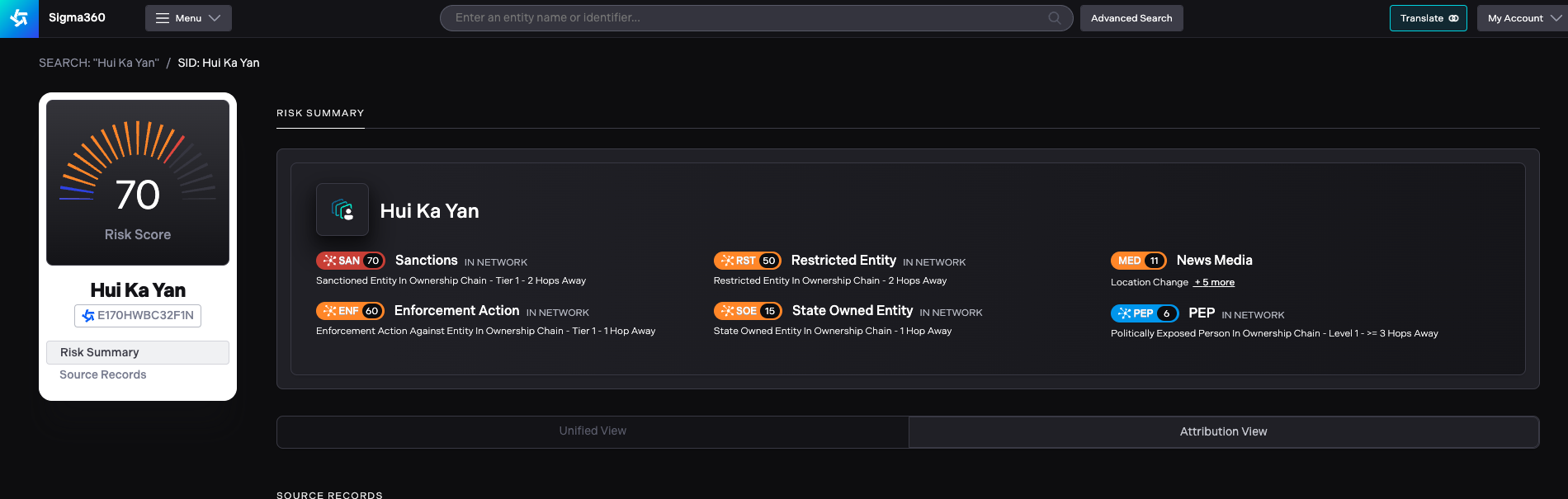

For example, embattled Chinese property developer China Evergrande (Evergrande) has been in the news for some time - with critical events and mentions captured by Sigma360 dating back to 2015. Along this arc, according to publicly available reporting, things have gone from bad to considerably worse at the company, including a Reuters article that cites that Hui Ka Yan, the 64 year old billionaire founder and chairman of Evergrande, is being "investigated for illegal crimes". This is significant, as real estate makes up some 25% of the Chinese economy and this is one of the nation's largest players.

While this breaking news certainly has an impact on Evergrande and Hui Ka Yan, it also raises questions about other companies and individuals that might be impacted that are related or associated, in this case, to the founder.

Through global media and other golden data sources, there are at least a handful of entities that may be impacted by this recent reporting. These relationships range from shareholding, to former business associates to other unrelated companies that may be facing similar issues. For example, the following are notable relationships that are quickly surfaced:

- Bank of Jinzhou - major shareholding by Hui Ka Yan

- China Bohai Bank - major shareholding by Hui Ka Yan

- Shenjing Bank Co., Ltd. - major shareholding by Hui Ka Yan

- China Vanke Company - major shareholding by Hui Ka Yan

- Xia Haijun - former Evergrande senior executive (CEO) reportedly arrested

- Pan Darong - former Evergrande senior executive (CFO) reportedly arrested

- Evergrande Wealth - related to China Evergrande

- Country Garden - debt embattled real estate developer

- China Oceanwide - debt embattled real estate developer

This is a small snapshot of some of the direct and indirect relationships that exist between Evergrande and its founder, some of which may be useful for an analyst determining the direct risk of Evergrande or evaluating a transaction associated with an Evergrande executive. Moreover, understanding these relationships helps further contextualize, for example, a search of Xia Haijun or China Oceanwide from the perspective of risk and similarity (e.g., China, real-estate company, significant headwinds, relational connection).

Getting ahead of the next Evergrande

Evergrande presents a nuanced, high profile and complicated case, but one that has played out many times prior and will do so going forward. That is, a company or person-centric event or issue with multiple connection points that are critical to understand in combination. To get ahead and track these changes, teams need to be able to quickly query companies to determine direct and indirect risk. Since 2020, Sigma360 has been working with Fitch Ratings and other large scale organizations to help them do just that.

What we have learned and built to help solve some of these challenges is a fully connected risk decisioning platform designed to surface what matters and connect it to other, more nuanced business facts that help a user 'see the full picture' and stand a better chance of 'getting ahead of the risk' in their counterparty relationships. And what's great is that this is an out-of-the-box capability, as well as one that can be further enhanced by connecting already resolved external data with data that is held internally by an institution.

How can Sigma360 help me stay ahead?

Using Sigma360's risk decisioning software platform, organizations can not only get ahead of risk, but leverage unstructured data - like the news highlighted in this article - to further contextualize its impact and how it manifests across other entities that may impact counterparty relationships.

Unsurprisingly, “terrorism related events” are being reported and covered from every corner of the world given recent events unfolding in the Middle...

Monitoring adverse media (also known as negative news) can feel like searching for grains of sand in a rushing river. The flow of information–in...

Adverse media screening is a core component of a well-functioning financial crime program and broader risk...