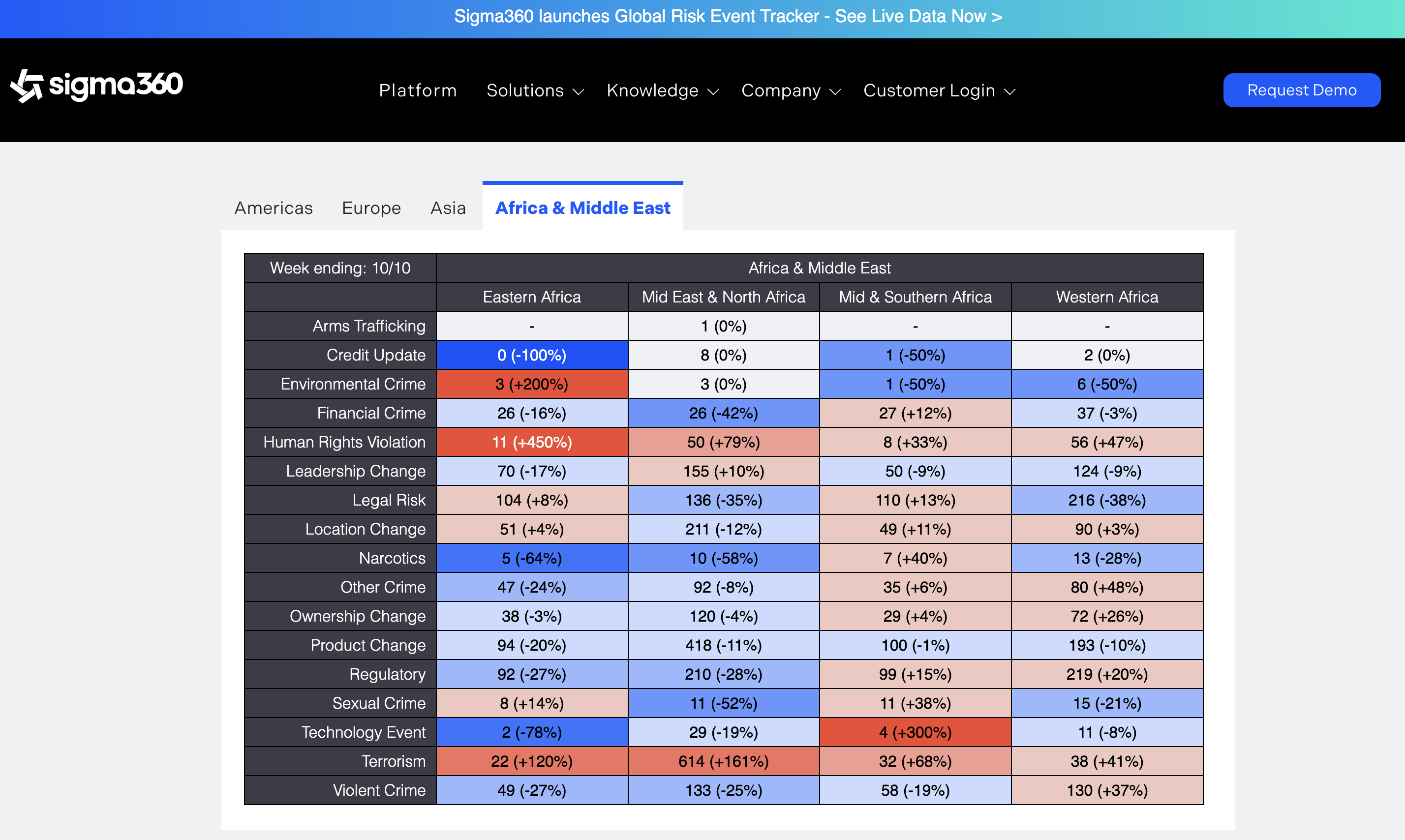

Unsurprisingly, “terrorism related events” are being reported and covered from every corner of the world given recent events unfolding in the Middle East. These stories are dominating the headlines and will continue to do so for some time.

Sigma360’s dynamic risk event tracker shows significant week-over-week increases across the entire Africa & Middle East region - including 614 new events in the Middle East alone. Behind this, however, are other warnings to evaluate across the global financial system - including potential Hezbollah access and benefit through diamonds, art and real estate.

To explore the event risk tracker for yourself check it out here: https://www.sigma360.com/solutions/adverse-media#heatmap

Mapping & Screening Against Illicit Financing Networks

The breaking events in Israel and Gaza follow earlier adverse media reports this year highlighting the U.S. Treasury’s issuance of new Hezbollah-related sanctions, including 52 individuals and entities that span the globe including in Lebanon, the UAE, South Africa, Angola, Ivory Coast, the Democratic Republic of the Congo, Belgium, the UK, and Hong Kong. What is important to note across these actions, is how funds were flowing and through which specific company types, countries and industries. With current events in mind, unpacking this is more important than ever.

Specific Examples to Highlight and Ensure Coverage On

Some examples highlighted earlier by Treasury include the following:

The examples above illustrate the breadth and depth of operations to circumvent sanctions, launder money and move value. However, this is the tip of the iceberg and highlights only a fraction of the people and companies working in concert to support Hezbollah (and ostensibly Hamas per public acknowledgement of the link).

For example, MSD specifically has numerous links to non-sanctioned companies that may or may not be active participants in continued operations to fund Hezbollah and circumvent sanctions. Adverse media screening and network risk reviews for potential links to terrorism are essential - particularly now - as the flow of funds (directly and indirectly) will happen rapidly as the war continues to intensify.

Considering Geographic Risk - Now More Than Ever

Firms should also take note of the geographic risk considerations highlighted in the Treasury action.

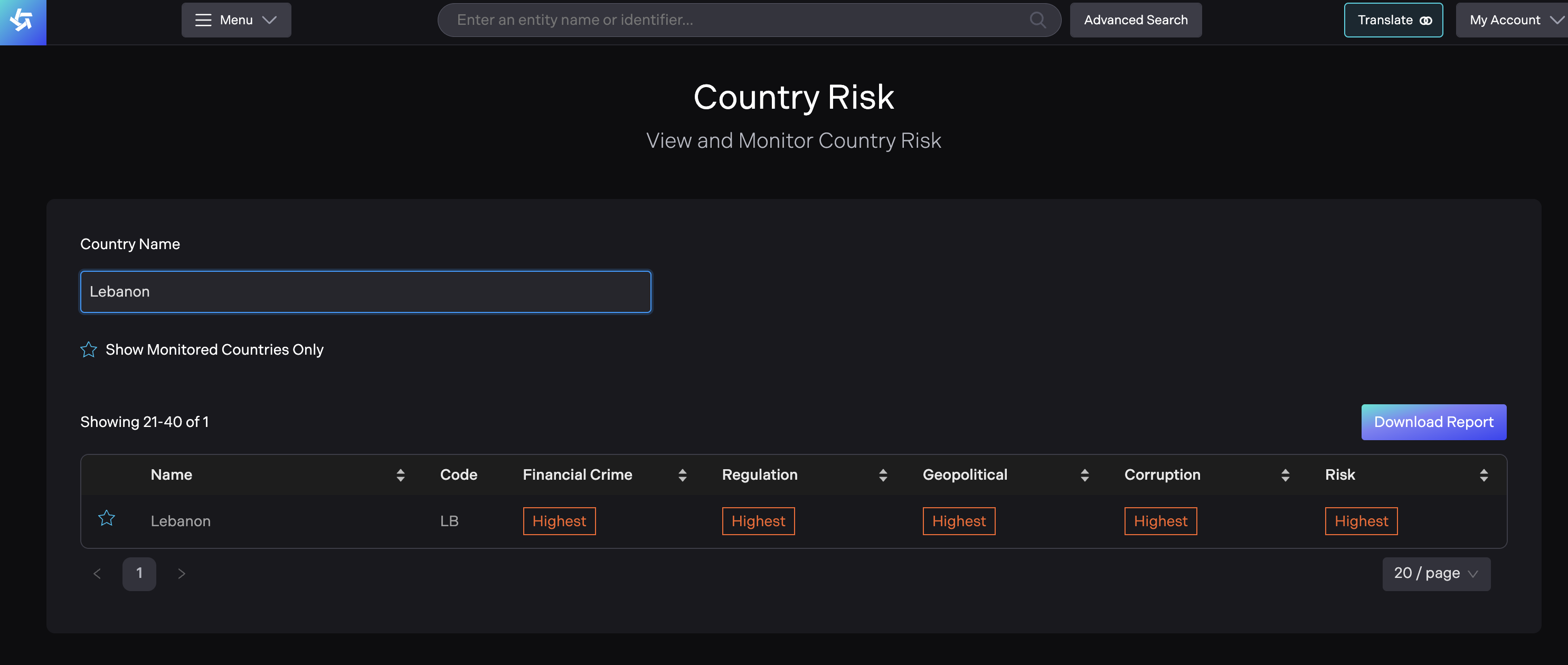

For example, the Sigma360 country risk model - which takes into account risk dynamics across four dimensions (financial crime, regulation, geopolitical and corruption exposure) outlines the following risk associated with the named countries above:

Lebanon - Highest, including highest for financial crime risk

South Africa - Medium, including high for financial crime risk

Angola - High, including highest for financial crime risk

Democratic Republic of the Congo - Highest, including highest for financial crime risk

Belgium - Low, including medium for financial crime risk

United Kingdom - Low, including high for financial crime risk

Hong Kong - Medium, including highest for financial crime risk

Also, more closely reviewing transactions in and out of these jurisdictions across precious stones, art and real estate in particular would be an additional control.

If we can help in any way please let us know.

How can Sigma360 help me stay ahead?

Using Sigma360's risk decisioning software platform, organizations can not only get ahead of risk, but leverage unstructured data - like the news highlighted in this article - to further contextualize its impact and how it manifests across other entities that may impact counterparty relationships.

Last month, the Council on Foreign Relations reported that an arrest warrant issued by U.S. law enforcement for a prominent Nigerian policeman, for...

From Wirecard to the Adani Group, staying ahead of changing risk - both direct and indirect - has never been more important and more critical for...

Monitoring adverse media (also known as negative news) can feel like searching for grains of sand in a rushing river. The flow of information–in...