Monitoring adverse media (also known as negative news) can feel like searching for grains of sand in a rushing river. The flow of information–in multiple languages, from sources of varying reliability, 24 hours a day–generates a vast amount of noise compared to the signals that financial institutions need to pick up.

As a result, there’s a tendency to buy into myths that validate the choice to make adverse news screening a lower priority as part of your risk framework –but those myths can lead institutions into trouble.

Reality: Manual adverse news searches can’t replace proper due diligence or catch changes as they happen across your clients and counterparties.

Manual searches can also miss key news if the search results don’t go back far enough in time, and the sources may not always be accurate or fully inclusive of what is available. In addition, if your clients do business in multiple countries, your team will need to search in multiple languages and vet the accuracy of translations, something that is not supported by Google searches..

Reality: By the time institutions find out about adverse news/negative news, the only available response may be facing penalties.

For example, Wells Fargo acquired Wachovia Bank in 2009. In 2010, the IRS and DEA implicated Wachovia on money laundering concerns for in laundering money for Mexican drug cartels before the merger. There had been reports before the merger mentioning Wachovia in relation to money laundering, which could have prompted Wells Fargo to examine the deal more closely and perhaps better manage avoid the $160 million in fines that Wachovia had to pay. More recently, we have seen the same in reporting on Wirecard and a number of Scandinavian banks caught in the crosshairs of Russian money laundering - adverse media/negative news that predates any official government action.

Reality: Claiming ignorance of adverse news may not offer protection in court.

Consider JPMorgan Chase’s recent $290 million settlement with victims of deceased sex trafficker Jeffrey Epstein. Epstein was first charged in 2006, but CEO Jamie Dimon testified that he he’d never heard of Epstein before 2019. A federal judge ruled that the evidence indicated that the bank “knew or should have known” about Epstein’s criminal behavior given public reporting.

Myth: Adverse news concerns only apply to people and businesses

Reality: Know Your Country is the often-overlooked KYC that can impact customers’ risk exposure, particularly at the supply-chain level.

For example, news about forced labor in the Xinjiang Uygur Autonomous Region of China highlights the need for further investigation of fashion clients, renewable energy equipment producers, and other clients whose supply chains include everything from spices to batteries, to identify potential violations of the Uygur Forced Labor Protection Act.

Reality: Sigma360’s Adverse Media Screening solution allows institutions to set their own risk parameters and track relevant risk news by category, as it happens, anywhere in the world.

Using Sigma360’s smart filters, users can easily tune for adverse media that fits their risk-based approach across relevance and materiality and ultimately drive a more accurate and efficient user experience at scale - saving significant time and resources.

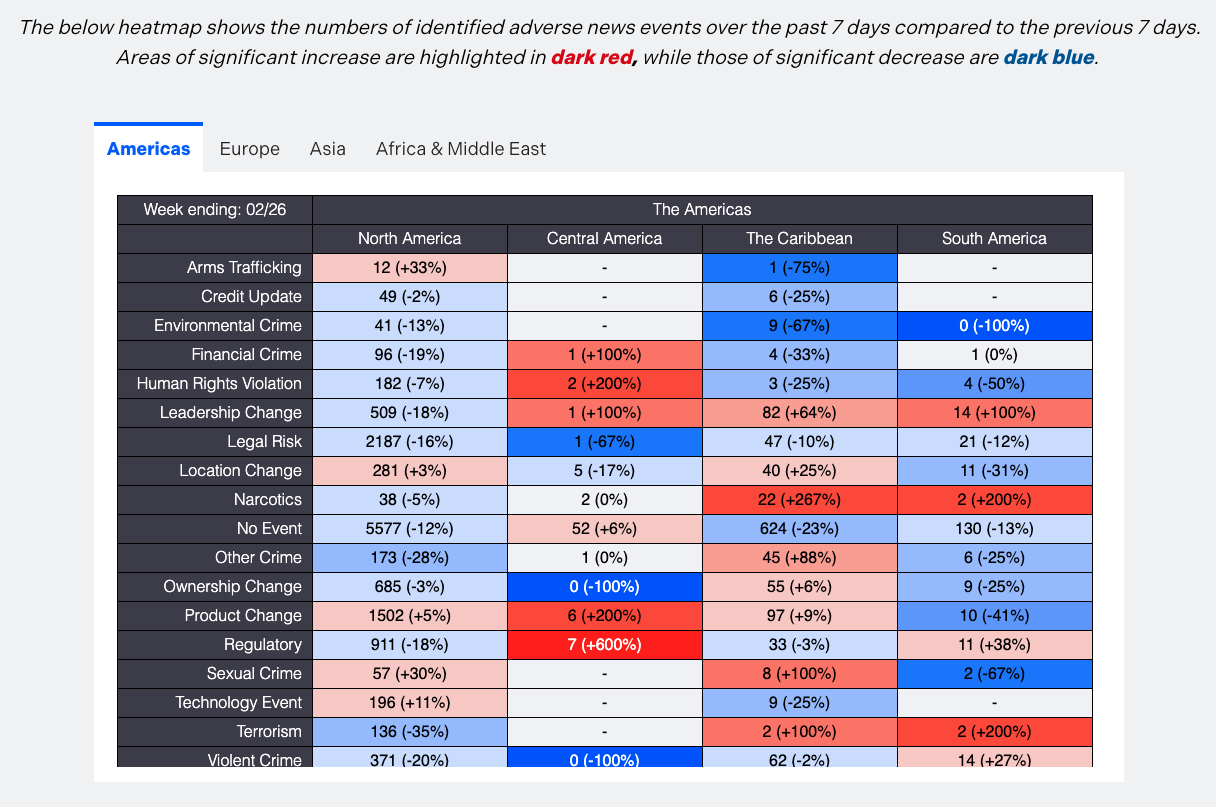

In addition, Sigma360’s Global Risk Event Heatmap allows institutions to track changes in negative news across regions over time and dig into related articles to better understand potential risk exposure trends.

How can Sigma360 help me stay ahead?

Using Sigma360's risk decisioning software platform, organizations can not only get ahead of risk, but leverage unstructured data - like the news highlighted in this article - to further contextualize its impact and how it manifests across other entities that may impact counterparty relationships.

When implementing a sanctions-compliance program, the U.S. Treasury’s Office of Foreign Asset Control (OFAC) has provided an invaluable resource in...

Meeting regulatory expectations - particularly with the...

Anti-money laundering (AML), sanctions compliance and anti-fraud expectations are rapidly changing, with new challenges and requirements coming...