Adverse media screening is a core component of a well-functioning financial crime program and broader risk management effort. This control has historically been cumbersome and costly to implement for a range of reasons. From a lack of coverage, to too many hits to simply irrelevant articles being surfaced, getting it right has not always been straightforward.

However, in today’s environment, not getting adverse media screening right can lead to missed financial crime and reputational risk, overwhelmed review teams and a less than ideal target operating model that can - and will - set an institution back in more ways than one. What's more, this control is now expanding beyond finance and banking and is increasingly seen as mission critical for supply chain due diligence and compliance, third party risk management and risk programs screening and monitoring for potential ESG risks in their relationships.

This Sigma360 blog outlines 5 steps you and your team can take now to help ensure you get your adverse media screening control right and at the same time get ahead of risk that may be hiding in plain sight by effectively leveraging it as a key control.

Not all adverse media is created equal. And not all institutions are the same either. Global financial institutions will have different risk-related concerns than regional banks. And payment companies and fintechs, increasingly under pressure from their banking partners, will need to do more to prevent access to their rails and at the same time manage costs of implementing controls like adverse media screening.

From a risk-based approach, what are the kinds of risks about a client that you absolutely must know? These typically include predicate offenses to money laundering, like fraud or narcotics trafficking as a starting point and can expand from there depending on your operations and definition. It also will include convictions and other definitive risks identified via official reporting channels (e.g., from the Department of Justice, FDIC, etc.). Starting with how your organization defines risk is an important departure point in the roll-out or improvement of an adverse media screening program.

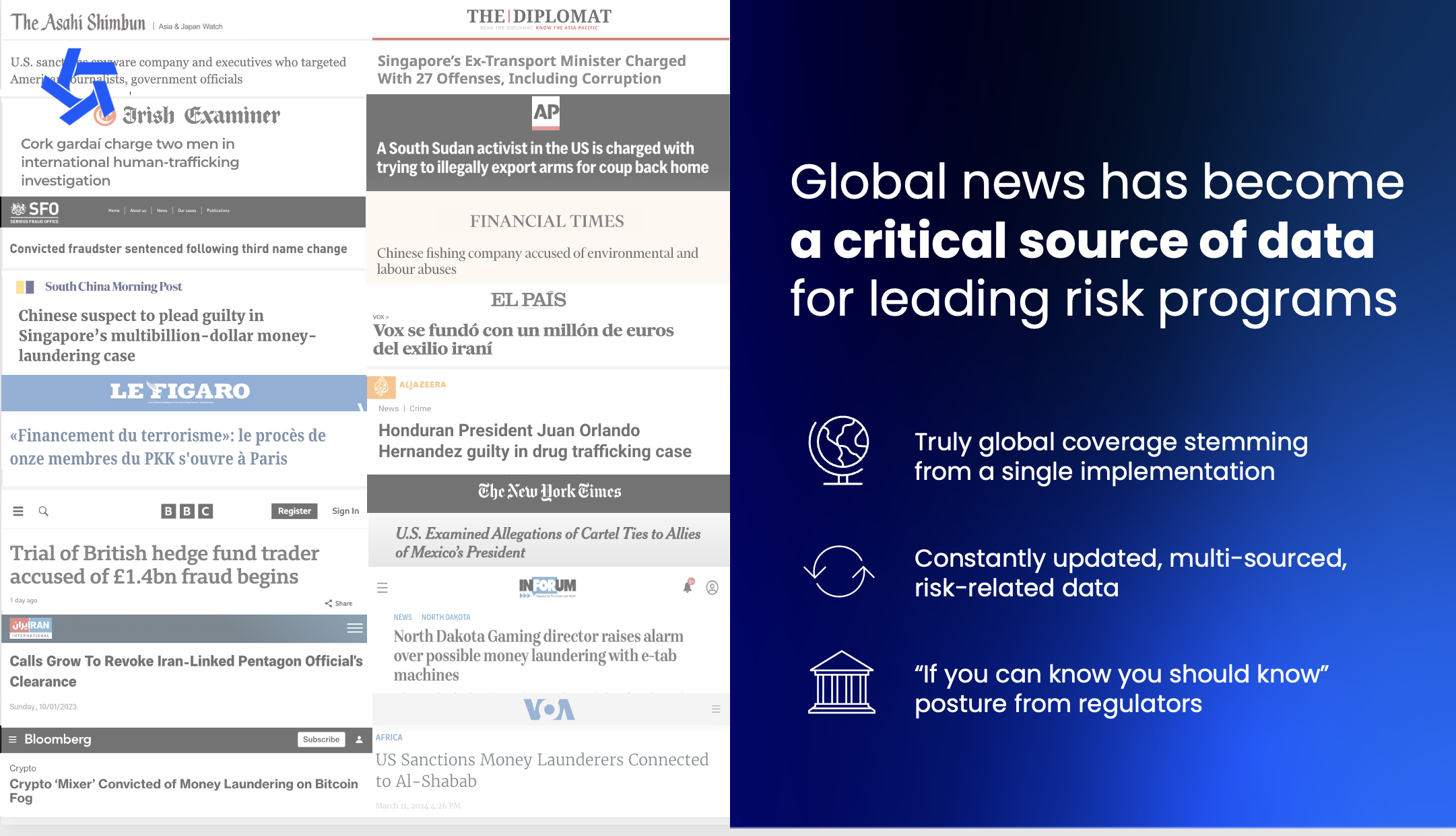

The coverage you include as part of your adverse media screening solution is critical to getting it right as well. Coverage can range from the geography of publication, to the type of publisher (e.g., well known global news publications vs. more nuanced NGO reporting), to the language the article is written in.

Dialing in what you care about and from whom can and will drive better performance across an adverse media screening program. You shouldn’t need to boil the ocean (that’s what your vendor is here to help with) - but you do need to define what you want to consider in your program as tightly as possible. Too often, firms miss this step and are overwhelmed with alerts that could have been avoided by scoping things a bit more.

Some examples to test can be found in our recent blog post on Russian sanctions evasion.

Applying adverse media screening across all operations is challenging for even the largest financial institution. Consider first, outlining where it can have the biggest impact as part of a risk-based approach. Some of those areas include:

Perhaps one of the most important steps is tuning your adverse media screening system. Ideally, this is easy to do via a web-based interface or through easy-to-implement APIs.

However, to be able to tune effectively, firms will need to work with a provider like Sigma360 that can go granular across its data to achieve this objective. The key levers for tuning include, but are not limited to: article relevance, article materiality and from there, a range of other knobs and dials that can further deliver optimal end-state results. For example, a regulatory event may have a spectrum of risk associated with it (e.g., local ordinance vs. financial institution is raided by police).

Additionally, outlining a measure of success is important. Typically, the ultimate measure is accurately delivering relevant articles based on your risk-based approach for your review team to process. From a technical perspective, also evaluating hit/catch ratio is certainly key too. Meaning, a reduction in non-productive alerts starts to work against you if you cannot ensure high catch rates.

The final step, of course, is creating efficient workflows for the hits you do receive. Ensuring that those can be worked optimally is critical. What this means is that your review team will benefit enormously from highlights, additional context, in screen views of the data they provided to the system and the ability to quickly move from alert to alert without delay.

Moreover, the system ideally enables feedback loops. Why was the article relevant? Why was the article not relevant? This data helps train smarter machine learning models, as well as the deployment of additional approaches to drive further tuning improvements.

Advances in technology and data availability mean that adverse media is now a viable control for financial crime and credit risk programs. According research from Chartis, adverse media is among the fastest growing aspects in the risk and compliance space and for good reason. However, getting it right, requires some thought and a vendor that is one hundred percent committed to delivering an optimal outcome.

What's more, rising regulatory expectations, as well as the general management of reputational risk, necessitate having in place always-on adverse media screening from the start of a customer relationship and as part of customer reviews over time. Not having it in place, exposes organizations to significant risk that could otherwise be managed. In many instances, more easily than one might expect.

Sigma360 is among the most advanced adverse media capabilities available today, powering global financial institutions, fintechs, corporates and government’s ability to make smarter decisions and intelligently leverage vast amounts of unstructured data alongside traditional screening data to do so. See Sigma360's system in action today and discuss with our team your readiness for a new approach to to adverse media.

To find out more about Sigma360’s approach to advanced adverse media capabilities please request your demo today.

How can Sigma360 help me stay ahead?

Using Sigma360's risk decisioning software platform, organizations can not only get ahead of risk, but leverage unstructured data - like the news highlighted in this article - to further contextualize its impact and how it manifests across other entities that may impact counterparty relationships.

Ensuring that your organization has in place a...

Over the past week, the world has watched the crisis unfolding in Ukraine in disbelief, anger and fear. Most of us watching from afar, including the...

In today’s fast-paced and highly regulated world, businesses can’t afford to wait for risks to materialize. Compliance and operations teams are...