A flurry of activity by the Biden Administration and other allied nations following the October 7, 2023 Hamas attack in Israel is the beginning of a global campaign that will almost certainly accelerate from here and impact financial crime and reputational risk operations for financial institutions and globally exposed corporates significantly in the months to come. Not to mention domestic warnings that the terror level for the United States has now been raised to a new level.

Currently, organizations are scrambling to understand their exposure (e.g., similar to the Russian invasion of Ukraine and potential direct and indirect exposure to the Kremlin) and doing so will require a close reading of U.S. Treasury statements, collaboration with the public sector, knowledge sharing and a review of current customer and counterparty risk exposure.

For example, research conducted by Sigma360 shows that:

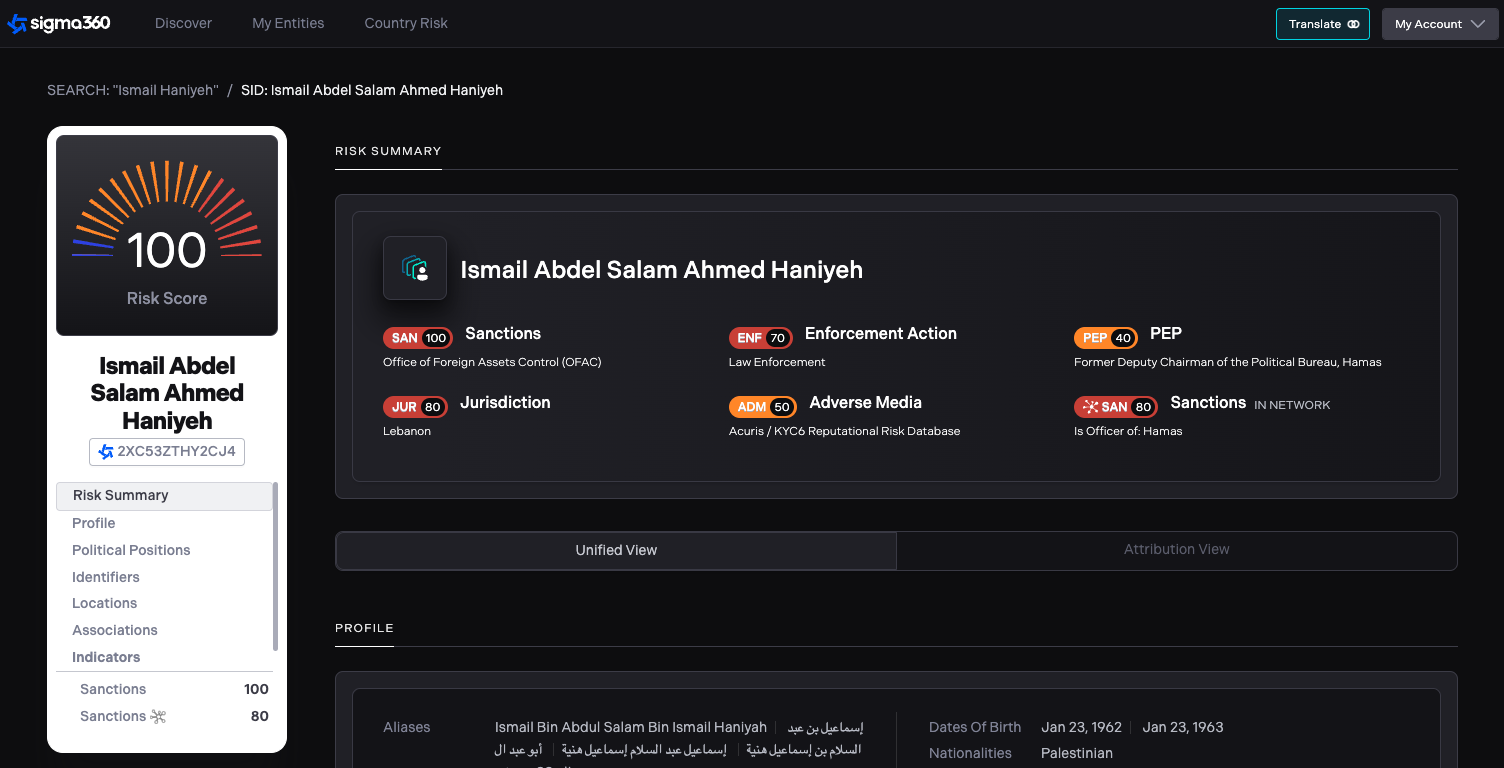

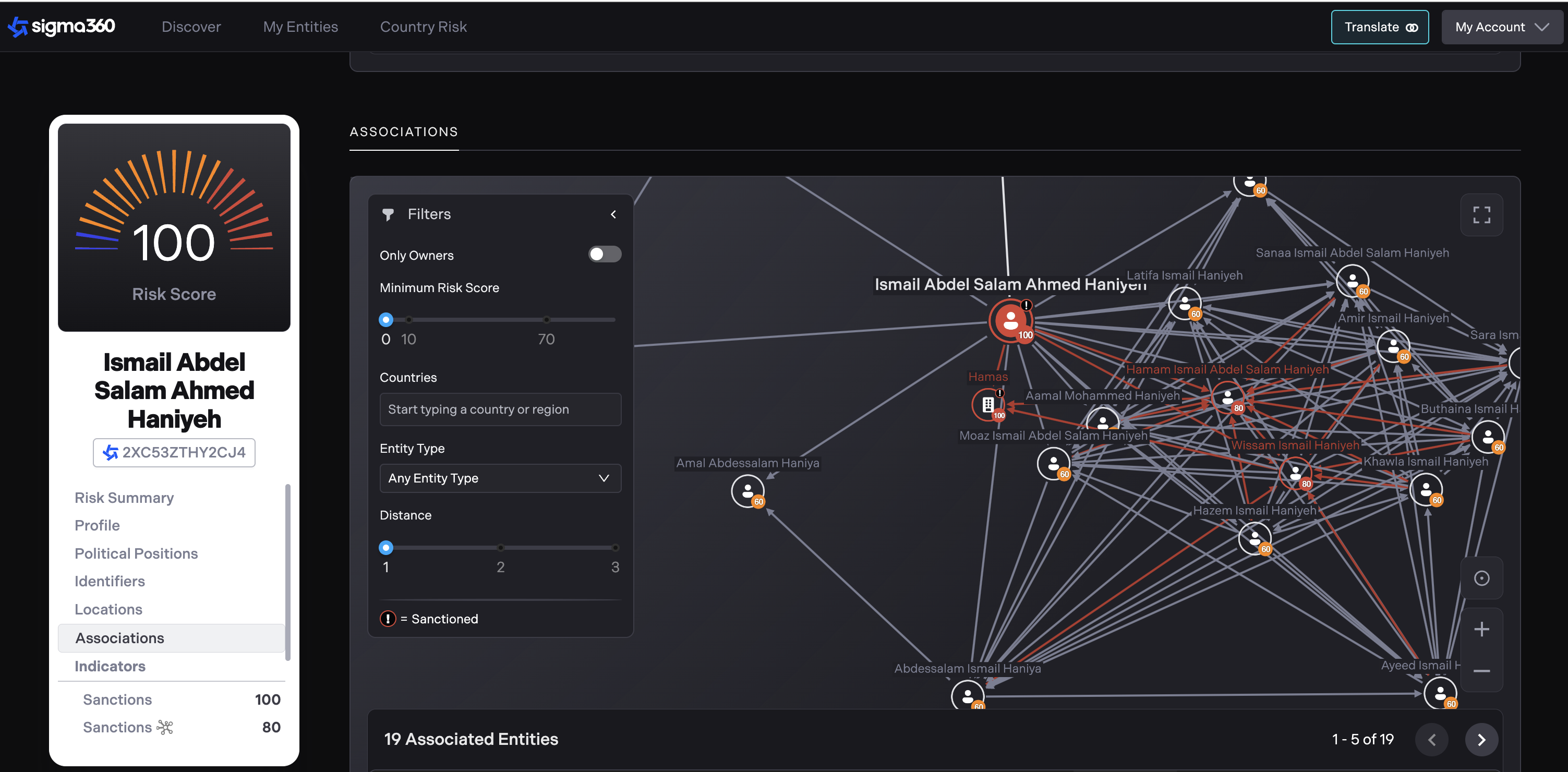

For example, Ismail Haniyeh, who is chairman of Hamas' political bureau, has hundreds of connections to people, companies and other organizations that are established through a range of public reporting, including, but not limited to media, watchlists and NGO studies. The first screenshot establishes overall risk (100 is highest), the second Haniyeh's network.

Ismail Haniyeh's network, numbering into the hundreds directly and thousands indirectly.

Work to ramp pressure on Hamas will likely unfold in a few different ways, but historically, the approach has been the same (and is already in flight, led largely by U.S. Treasury Department given its resources and prior experience in targeting and quickly rolling out new sanctions). Ensuring that one’s organization has in place strong policies and procedures, technology and capabilities to surface risk - particularly as it relates to international transactions - will be important. This brief can help firms better prepare for, locate resources/capabilities and get ahead of what is likely to come in the months ahead.

The initial government response

In the days following the attacks, the U.S. Treasury Department rolled out a number of additional sanctioning actions targeting Hamas and its enablers. Keep in mind, the U.S. designated Hamas and PIJ in 1997, far earlier than other nations and has maintained a fairly aggressive stance on the group since that time. However, in comparison to Iranian groups or al Qaeda for example, the breadth of sanctions applied against Hamas has not been equal in its application. Following October 7, however, that started to change, including the following additional names and entities that were promptly sanctioned:

- Members of Hamas’ political bureau and financiers further abroad (e.g., in Sudan);

- Operatives in Turkey associated with Hamas, including Trend GYO which was sanctioned earlier in the year (and is publicly traded on the Turkish stock exchange, giving it a more global nexus to investment firms);

- An operative based in Qatar; and

- Buy Cash Money and Money Transfer Company (Buy Cash), a Gaza-based money transfer and currency exchange, along with its owner

These sanctions were followed with additional actions rolled out last week, on October 27, 2023 that included:

- A Jordanian operative who is based in Tehran, as well as others in Iran;

- Iranian Revolutionary Guard Corps members involved in training Hamas and PIJ;

- A range of Sudanese-based businesses; and

- Additional individuals in Turkey with shareholding in Trend GYO

Initial U.S. Treasury Guidance

On October 20, in coordination with other sanction actions, and as noted above, the U.S. FinCEN issued an alert on Hamas directed at financial institutions. The alert outlined several red flags that institutions should be on the lookout for and operationalize. Some that were specifically highlighted include:

- Transactions with OFAC-designated entities and individuals, or transactions that contain a nexus to identifiers listed for OFAC-designed entities and individuals. This includes addresses, physical addresses, phone numbers, or passport numbers, or virtual currency addresses.

- Money Service Businesses or other financial institutions operating in higher-risk jurisdictions tied to Hamas activity.

- A customer conducts transactions that originate with, are direct to, or otherwise involved entities that are shell corporations, general “trading companies”, or other companies with a nexus with Iran or other Iran-supported terrorist groups, such as Hizballah and Palestinian Islamic Jihad.

- Other risks are tied to charities with Hamas-related activity, understanding who is behind the charitable donations and the use of virtual currency addresses tied to terrorist and terrorist financing activities.

More Pressure Comes with More Time

From here, the Treasury and allied nations will look to further target the broader Hamas network and leverage international information sharing conduits to build out a more comprehensive picture of Hamas and its global enablement network. The link between Hamas, October 7 and agents of Iran is increasingly being drawn through public statements and designations, suggesting that the expansion on this link will continue - which means careful view of direct affiliations, as well as enablers that are likely in major transit hubs that may be used by Hamas or others.

In face, this further played out this week, as predicted, with a joint action by the United States and the United Kingdom against PIJ, drawing out its nexus to and relationship with Iran. The action highlighted the movement of money to buy weapons and provide operational support, naming both individuals and companies involved in this activity.

With recent FinCEN and official readout note guidance in mind, this list of focal areas will invariably include companies and individuals in Iran, Lebanon, Syria, Iraq, Turkey, Sudan, Palestine, Qatar, Yemen, the wider GCC and others with close economic, trade and geopolitical ties. It will also include a view into companies and people with associated addresses, virtual wallet addresses, etc. For example, understanding whether or not companies share physical addresses, ownership, etc. with recently named companies and individuals will be important and is not provided by standard watchlists or technology providers.

More specifically, identifying key charities, money service businesses, front companies and other virtual currency entities with links to Hamas - and multi-hop links through the IRGC - will likely be increasingly in focus. Financial institutions and corporations will benefit from taking proactive steps to identify potential links between their customers and customers’ customers (or KYCC), particularly in and around higher risk jurisdictions and industry types.

Enlisting the Private Sector and Partner Nations

Moreover, recent statements and corresponding travel have been conducted by high-ranking U.S. officials, including the Secretary, Deputy Secretary and Under Secretary of the Treasury. These trips are designed to announce new actions, as well as to meet with banking and other host nation public sector colleagues to share information and to urge collective action.

One notable update in particular, was an emergency meeting called by member nations of the Terrorist Financing Targeting Center (TFTC) that was co-chaired by the United States and includes participation from the Gulf Arab nations of UAE, Saudi Arabia, Kuwait, Qatar, Bahrain and Oman. A further, specific trip, was made by U.S. officials to Qatar as well.

U.S. Treasury Under Secretary Brian Nelson noted at the TFTC meeting:

“Pursuant to the mandate of the TFTC, we must share more information and perspectives on the key nodes in the Hamas financial ecosystem that are vulnerable to disruption. Hamas financiers have long enjoyed unimpeded access to many jurisdictions and likely their financial systems as well. We need to better understand these networks, and more importantly, stop this activity if it is occurring in our jurisdictions.

Your insights and actions are vital to understanding and acting against the threat picture this group poses to the Gulf.

However, it is not enough to share information. We must act.”

Acting unilaterally has immediate and meaningful impact, but action is far more effective as a coordinated front. The United States and allied nations will be working hard through the Financial Action Task Force (FATF) and other multilateral bodies to renew attention to and action on countering the financing of terrorism. This was already on display at the FATF Plenary meeting on October 28th where the use of crowdfunding was highlighted, as was the importance of increasing guards against terrorist financing and illicit finance more generally.

As the world learned following 9/11, terrorist financing is much harder to track and disrupt than money laundering, largely because terrorist financing need not necessarily be dirty money. Therefore, understanding networks and potential linkages - particularly as it relates to in scope, higher risk jurisdictions - will be critical.

What's Next and How to Ensure You Know Your Risk

Additional entity and individual targeting from here will certainly happen, as well additional, more specific guidance around red flags and areas to focus efforts in stemming Hamas’ access to the international financial system.

Firms should ensure they are able to quickly respond to updates from OFAC, guidance from FinCEN and apply additional tools and capabilities to identify risk in customer and customers’ customer relationships across higher risk industries and geographies. Some steps concrete steps firms can consider:

- Refresh country risk models in line with recent activities, guidance and other reporting

- Ensure robust, accurate and fast updating of OFAC and other list screening capabilities across business lines

- Leverage data and technology that can quickly identify links between entities and people - to include shared addresses, ownership, etc.

- Utilize comprehensive news coverage and entity mapping from the news to detect and mitigate direct and indirect risks that are not covered by list providers

- Ensure someone is monitoring changes and statements from governmental bodies on actions that are being taken - and understand why they are and what impact it might have on one’s enterprise

- Review transaction monitoring rules in light of recent reporting and heightened risk associated with terrorism more broadly

How can Sigma360 help me stay ahead?

Using Sigma360's risk decisioning software platform, organizations can not only get ahead of risk, but leverage unstructured data - like the news highlighted in this article - to further contextualize its impact and how it manifests across other entities that may impact counterparty relationships.

This week, the outgoing U.S. administration has continued its “aggressive use of sanctions” with a flurry of designations in its final days. In...

The Office of Foreign Assets Control (OFAC) is a department of the U.S. Treasury that is responsible for enforcing economic and trade sanctions...

Last week, the WSJ reported that the Biden administration plans to limit the use of sanctions in a foreign policy shift, which Treasury officials...