Sigma360®, the definitive AI-powered risk screening and monitoring platform that enables compliant global relationships, today announces the launch of three GenAI-based product enhancements. Available as feature add-ons to Sigma360's existing flagship technology platform, and capable of working together or as standalone features, the new GenAI suite addresses three top compliance challenges:

"Compliance leaders and their teams need more than just data—they need context, speed, and automation to stay ahead of financial crime risks and meet regulatory requirements," said Stuart Jones Jr., CEO of Sigma360. "Our continued investment in AI and GenAI innovations sets us apart and represents a new standard for how organizations detect threats, make informed decisions and maintain compliance with confidence."

Sigma360's latest platform enhancements transform how financial crime teams operate, combining machine learning, Large Language Models (LLMs), and AI-powered intelligence to cut through complexity and deliver real-time insights where and how they need. These improvements are delivered across the following new capabilities:

The following new capabilities can work in addition to the L1 Agent or as standalone features:

"Ever increasing cost in technology and data coupled with rapidly evolving regulatory requirements, has the compliance technology market primed for generative AI adoption," said Phil Wittmann, SVP of Client and Partner Solutions. "With generative AI model evolution, and our investment in responsible and ethical development of AI, we are committed to helping compliance and technology executives successfully embrace generative AI into day-to-day compliance initiatives that are proven to reduce operational burden and enhance decision making with full transparency and oversight to meet regulatory requirements."

About Sigma360

Sigma360's cloud-based data platform has emerged as the definitive choice for point-in-time risk screening and perpetual client monitoring. Underpinned by thousands of fully integrated and hosted data sources and proprietary entity resolution, risk extraction and scoring algorithms, the platform can identify and return direct and network-based entity risk at sub-second speeds. Sigma360's solutions are used by financial institutions, asset managers, professional services firms, fintechs and global corporations seeking to consolidate operations into a singular risk intelligence platform and more efficiently manage the entire client lifecycle.

To find out more about Sigma360’s approach to advanced adverse media capabilities please request your demo today.

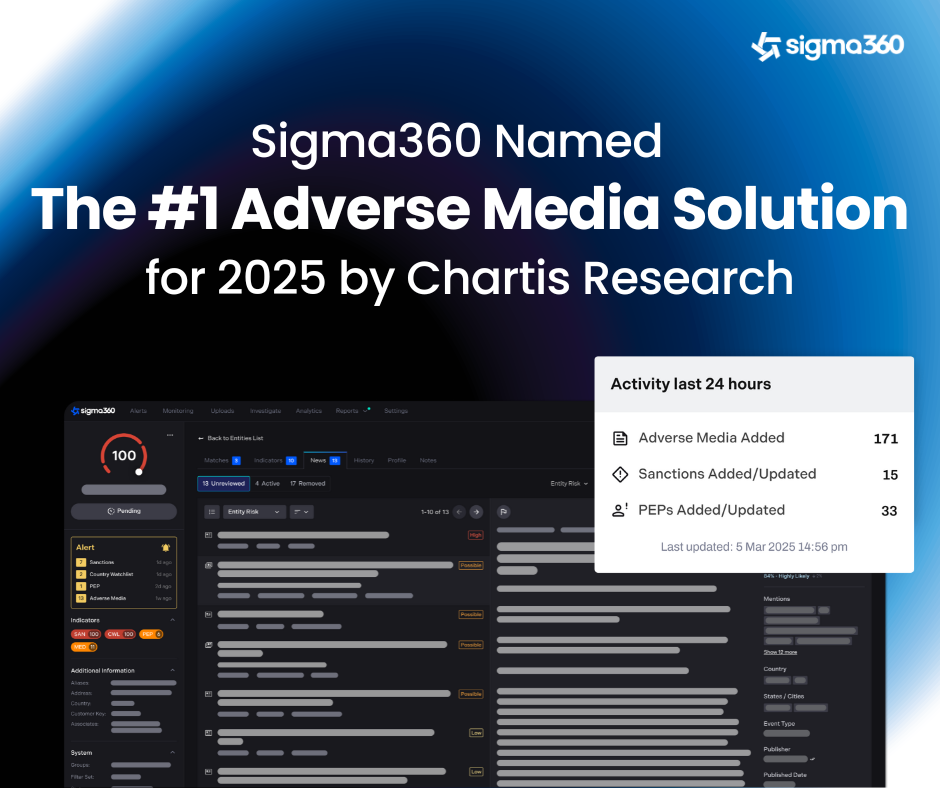

Sigma360®, the definitive AI-powered risk screening and monitoring technology platform, has been independently recognized as the #1 Adverse Media...

March 20, 2024

Award builds on prior recognition as a global leader in KYC, across watchlist and sanctions screening and advanced adverse media

NEW...

Sigma360®, the #1-rated Adverse Media Screening solution by Chartis Research in 2025, has announced the launch of News Event Resolution, a major...