Financial institutions are required to put in place programs to detect and prevent money laundering. One of the most cited anti-money laundering (AML) red flags by government - over the last 18 months - to look for is the use of shell companies. With this in mind, does your institution have a program in place to identify shell companies in transactions? What about shell companies with identifiable sanctions and watchlist connections?

Shell company detection is an area that the team at Sigma360 has been focused on for while. While imperfect, there are a number of steps that can be taken to auto identify likely shell companies that include, but not limited to:

i) Formation date - is the entity a newly formed company

ii) Location - is the company located in a jurisdiction known for tax secrecy or sanction evasion

iii) Association with known shell companies - does it share other characteristics with known shell companies

iv) Line of business detection - can this be established and does it make sense alongside transactional records

v) Internet presence - is there self generated content and information on the entity

Financial institutions have a range of additional approaches at their disposal to identify shell companies, such as shared directors and recognition of known incorporation agents who have been linked to shell company operations in the past. These techniques can be employed by institutions to enhance their ability to detect and prevent money laundering activities and to identify potential sanction evasion or nexus.

Why is shell company detection critical?

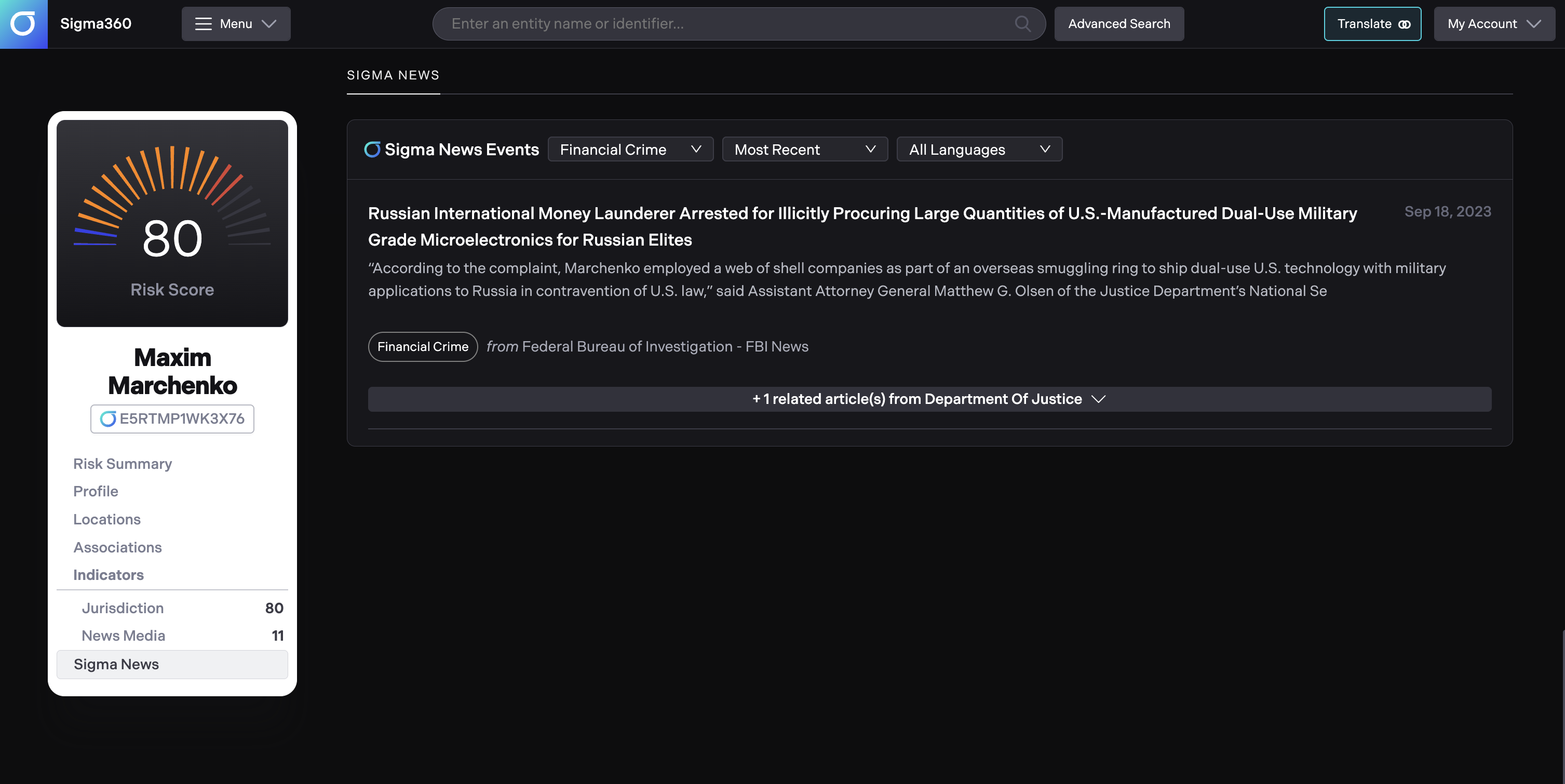

Beyond regulatory obligations to detect money laundering, current geopolitical developments make identifying shell companies important from reputational perspective. Take the case of Maxim Marchenko, who the U.S. Department of Justice recently charged for money laundering and sanction evasion.

According to filings, Marchenko and his accomplices used a number of shell companies in Hong Kong to evade detection and procure and supply military equipment to Russia. The shell companies named include:

- Alice Components Co. Ltd. (Hong Kong)

- Neway Technologies Limited (Hong Kong)

- RG Solutions Limited (Hong Kong)

These entities present real risk - using the rubric above - from the perspective of potential shell company activity. Online reviews also support the nexus, via trade data, with Russia, which is tracks with the Department of Justice filings.

How can Sigma360 help?

Without the need for a drawn out political process post Election Day, the Trump transition team can begin to evaluate key hires across the...

Ensuring that your organization has in place a...

On November 21, 2024, the U.S. Treasury Department escalated its sanctions compliance efforts by targeting Gazprombank and several smaller Russian...