Fighting financial crime and enabling a more proactive risk management posture benefits from robust, always-on adverse media detection (also known as negative news screening). Today, depending on an institution's policies, firms utilize adverse media screening to identify potential risk in customer and counterparty relationships at both a point-in-time and on an ongoing basis. And many times, this approach is manual, relying on a range of applications and ad hoc searches to exhaustively determine whether there is risk or not.

In our view, the next generation of adverse media screening benefits from further data optimization to help users not only surface the risk that matters (using relevance and materiality as drivers for accuracy), but to also quickly surface, link and contextualize relational risk at scale. In other words, media can not only help users stay ahead of risk by flagging critical mentions, but further connect the dots and determine risk on a network basis.

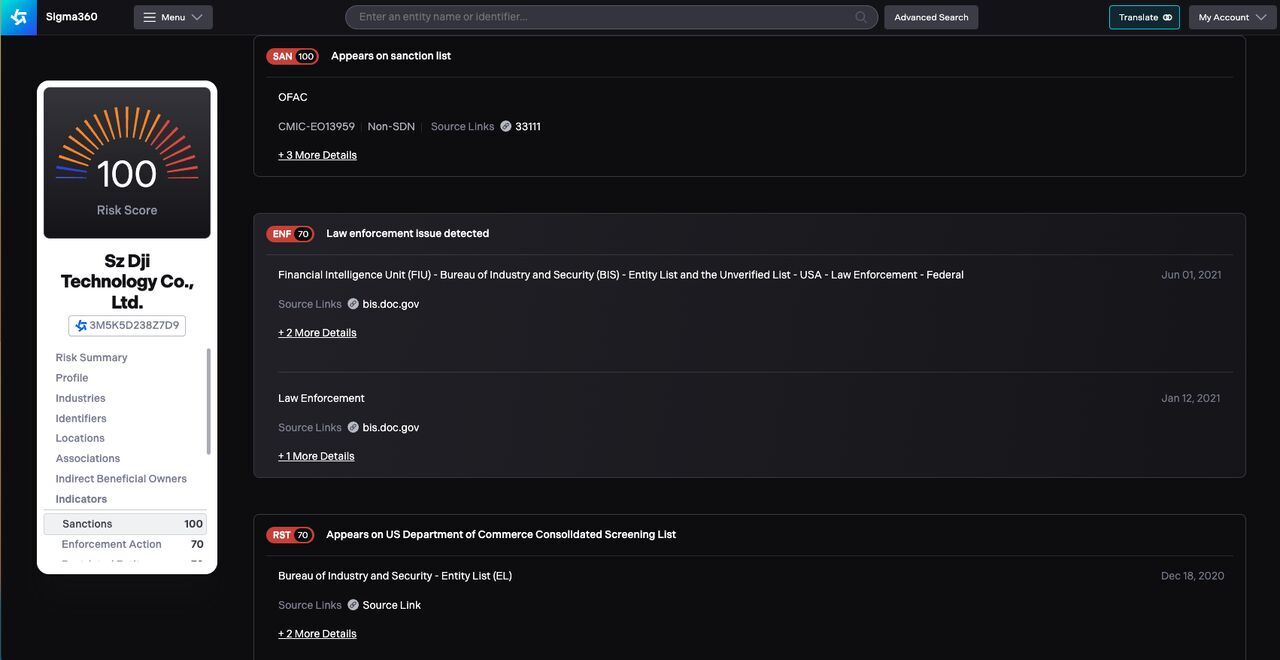

Sigma360's adverse media screening capability is always-on, scanning hundreds of thousands of sources to determine the entities and risk types that are reference in each article. This machine-driven approach enables scale, speed and accuracy on a global basis and across some 50 languages.

Unsatisfied with the status quo in adverse media screening, Sigma360 developed its solution with 18 distinct and proprietary risk event types. These event types range from risk-on events like financial crime and narcotics to others that are useful in understanding what your clients is doing like ownership change, location change and product change. This approach greatly helps adverse media screening users:

i) Quickly determine risk by event tag;

ii) Ensure globally detected risks are surfaced quickly;

iii) Ensure material risks are surfaced first

Unstructured into structured insight

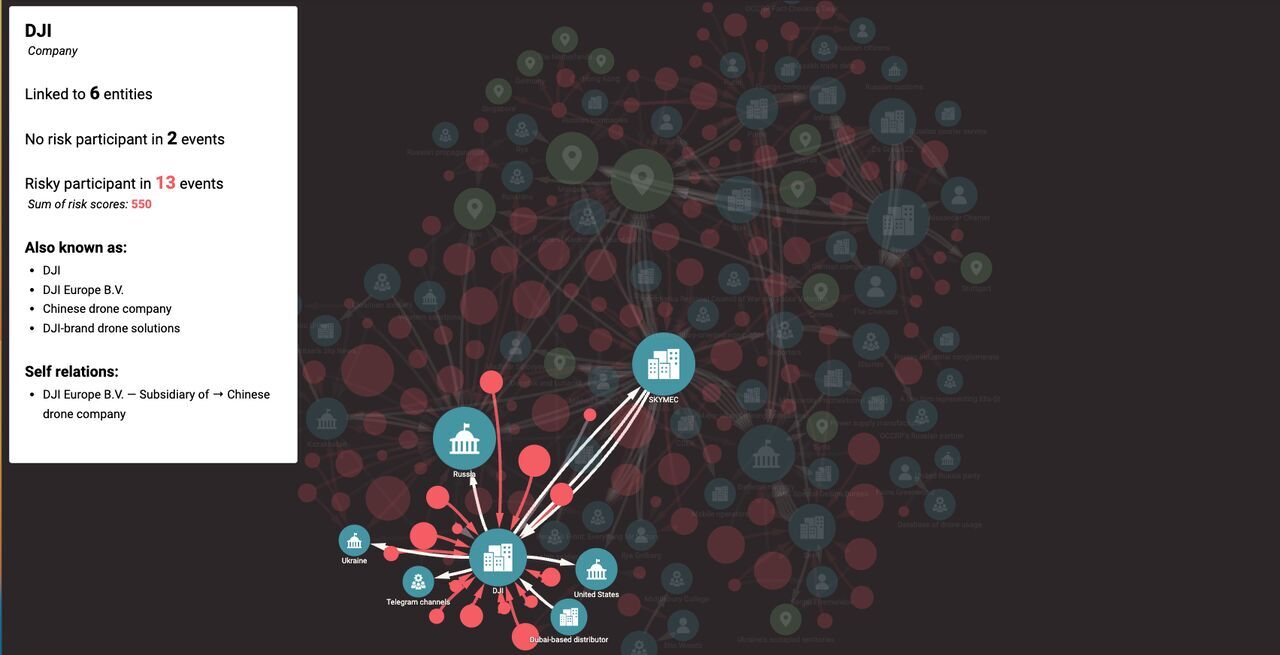

To build on this investment in adverse media screening, Sigma360 has separately developed ArticleAI to further optimize media and extract from it further context. Where legacy providers stop, Sigma360's ArticleAI starts, providing additional insight into the entity searched and automatically drawing connections to other people and companies across the entire corpus of articles, as well as golden source data (e.g., watchlists, corporate registries and other databases).

Some of the immediate benefits of ArticleAI versus traditional approaches include:

i) Connect relational insight that would otherwise be missed;

ii) Speed up time to insight by surfacing connections that would have otherwise been missed or required additional searching to find and uncover;

iii) Deepen article relevance scoring through risk co-reference

For example, in the image below, DJI, which is sanctioned, is also connected through a range of events- determined via this article - to other 'enablers' including, but not limited to. These events or "risk facts" are established using ArticleAI:

- Skymec, Group 22, Dubai-based distributor, Russia and many others.

Enhanced using ArticleAI to illustrate connectivity established through unstructured data.

How can ArticleAI help me?

Using Sigma360's ArticleAI, organizations can not only get ahead of risk, but leverage unstructured data to further contextualize it and take adverse media screening to the next level.

The Sigma360 platform is the definitive risk decisioning software for financial crime, credit and supply chain teams seeking to detect and manage risk in their customer and counterparty relationships.

When it comes to sanctions compliance, increasing geopolitical uncertainty is pushing governments to tighten regulatory expectations. As a result,...

In financial crime compliance, the most expensive risks are not always the ones you detect.

They are often the ones that slip through unnoticed...

Last week, a Swiss court demanded compensation of $45 million from Credit Suisse in a money laundering case concerning a Bulgarian drug ring....