Knowing your clients and knowing your risk go hand-in-hand.

To do this effectively, firms should look beyond government watchlists and antiquated transaction monitoring systems with an eye toward leveraging smart data more centrally to screen at the time of onboarding and on an ongoing basis. The marriage of tech, smart data and human skill are essential to meeting regulatory obligations and protecting the integrity of your institution and the international financial system.

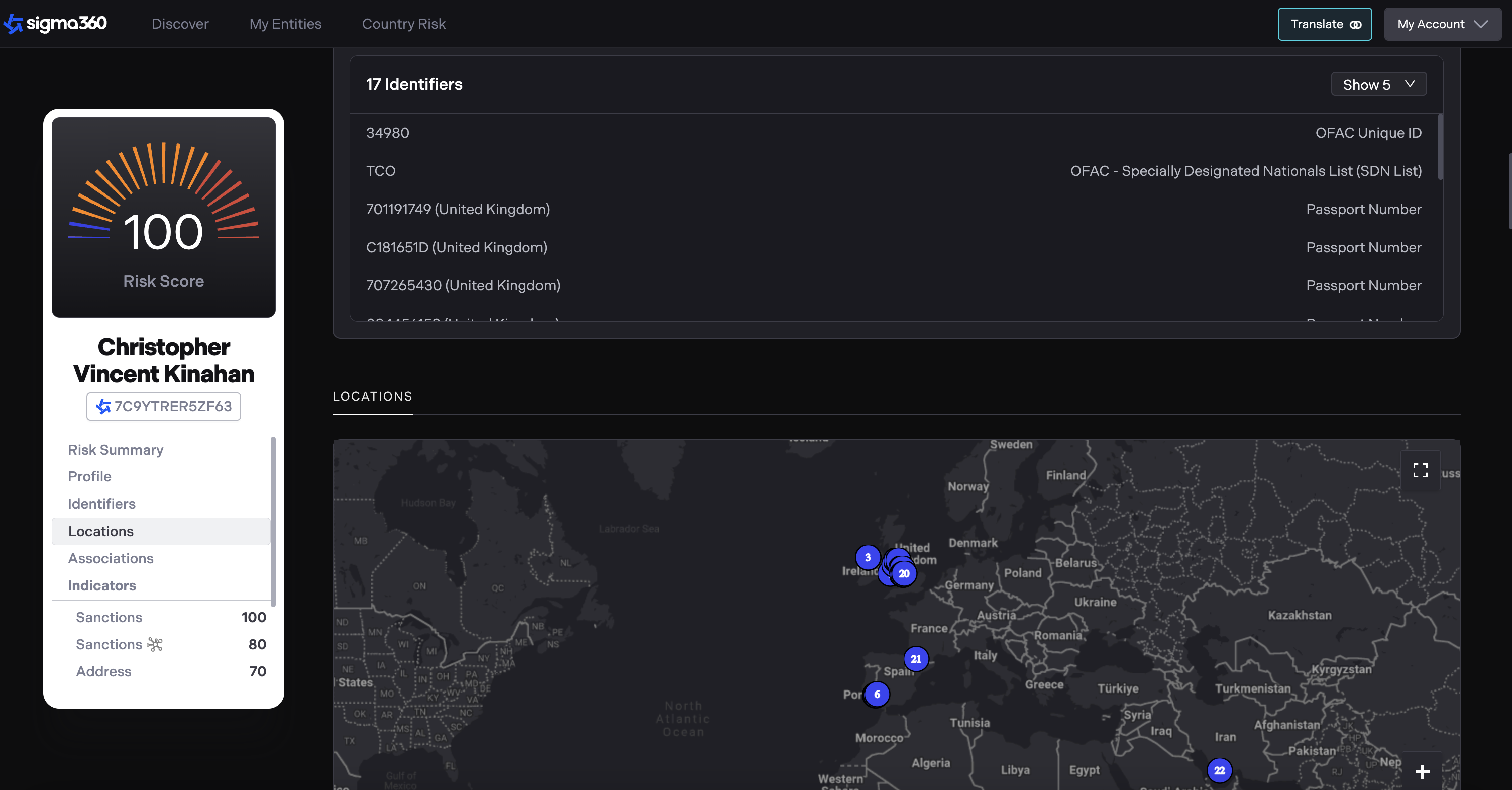

Case-in-point, Chrisopher Vincent Kinahan, an Irish taxi-driver turned global cocaine boss. A model prisoner in Ireland who polished his language skills in prison (learning multiple) and sought upon release to be among the largest drug dealers in the world. He succeeded and along the way, built a global, criminal network to meet those objectives.

Image: Risk view of Christopher Vincent Kinahan

What we learn from the case of Kinahan, and so many others like him, is that without smart data, advanced matching algorithms and the ability to truly ‘connect and contextualize’ the data, risk hiding in plain sight is otherwise missed. In a review of multiple other leading risk and compliance data sets and systems, information on Kinahan is either missing, hard to find or altogether incomplete. Meaning, Kinahan’s relationships and other ventures go unflagged.

Kinahan: A Truly Global Network

While Chris and the Kinahan Organized Crime Group were sanctioned by the U.S. Government in April 2022, his associations that have been established/linked through both structured and unstructured data extend far beyond what has been previously reported. For example, Sigma360’s out-of-the-box platform capabilities find more than 75 links between Kinahan and other individuals and companies. These links include, for example, shareholding, as well as co-mentions in Sigma360 automated adverse media screening, shared/high-risk addresses and names found in previous investigations.

Regulators expect institutions to move increasingly in the direction of effectiveness - something we believe can be leveraged by any institution today. As a leader in screening across watchlists, PEPs and adverse media, as well as true network analytics, Sigma360 has you covered regardless of your institution’s size or technical stack.

Deploying Advanced Capabilities at Your Organization

Some common concerns and objections we have heard associated with the move to include network analytics include, but are not limited to the following:

- Myth vs. Reality: Deploying network-based screening and investigations is time consuming and expensive. While this may be true with some vendors, Sigma360 can be deployed in a matter of weeks, is cloud-based and can provide a network-centric view of customers and customer’s customers. We serve the world’s largest banks and payment processors, as well as smaller broker-dealers who want to deploy a world class capability.

- Myth vs. Reality: More data means more work for my team. The opposite is true, as Sigma360 clients benefit from full risk contextualization out-of-the-box, including full configurability of the risks they see. In the instance of Christopher Vincent Kinahan above, a user could screen for sanctions or on the fly expand their view to include the network view depending on the stated objective.

- Myth vs. Reality: This may not fit into my current compliance stack. Not only can it easily bolt on, but Sigma360 can easily handle scalable screening, large scale monitoring, investigative workflows and perpetual KYC.

How can Sigma360 help me stay ahead?

Using Sigma360's risk decisioning software platform, organizations can not only get ahead of risk, but leverage unstructured data - like the news highlighted in this article - to further contextualize its impact and how it manifests across other entities that may impact counterparty relationships.

Ensuring that your organization has in place a...

In today’s fast-paced and highly regulated world, businesses can’t afford to wait for risks to materialize. Compliance and operations teams are...

Risk managers faced significant challenges in 2023 and also experimented more deeply with the promise of technology to keep up and stay ahead in an...