While KYC stands for “Know Your Customer” and is at the heart of AML efforts, for compliance teams it can be just as important to “Know Your Country” as well. Having an understanding of country risk is an essential component in risk analysis, for it can often have a great bearing on determining potential issues associated with a customer or a transaction.

Country risk is used in a number of different settings - from evaluating credit risk, reputational risk and, of course, AML risk. In 2018, the Wolfsberg Group published a long list of FAQs regarding country risk in which they followed up on the importance of country risk in the Risk Based Approach (RBA) they had published twelve years prior in 2006.

Simply put, country risk refers to certain jurisdictional attributes that account for a higher probability that an individual or entity from that region would have a higher risk of financial crime associated with them. This can range from political stability, to law enforcement efficacy to the presence of strong criminal networks in the country. As the Wolfsberg group aptly advised, “when assessing a customer’s risk profile, Financial Institutions (FIs) need to consider not only the financial crime risk related to the customer and the customer’s source of wealth, but also the legal frameworks and their effectiveness, as well as the political environment in the countries where the customer is active.”

But how can this be done effectively? It should first be noted that there is no one-size-fits-all answer. Every institution will have their own risk appetite and will have to balance business operations with the level of risk they are willing to take on with each particular customer. This will determine how country risk indicators will be modeled, weighted and acted upon internally.

Some of the most common risk indicators we see in general country risk ratings are as follows. However, this is by no means an exhaustive list.

While the above provide a good starting point, it is often required to dig a bit deeper. Countries are large places and the distribution of risk is certainly not evenly distributed over a nation. Furthermore, many of the traditional risk indicators remain static until they are updated on a quarterly or yearly basis.

Therefore, we have taken steps at Sigma to bring in some more clarity when it comes to looking at territorial risk and provide a representation that keeps up with the rapidly changing state of the countries analyzed. For instance, Sigma’s own Country Risk Rating methodology includes not just the indices listed above as well as proprietary indicators, but also aggregates news so clients can have customizable notifications on a country, city or municipality. This enables their analysts to stay up to date and gives more color to both the top-line risk rating as well as risk subcategories (such as Financial Crime, Regulation, Geopolitical and Corruption).

Furthermore, we are continuing to expand our Global News Coverage, making this process even more robust and giving institutions the ability to run these events into their own risk models. Having flexibility in country risk rating is key, as each institution’s business model and risk appetite call for the ability to adjust the model as necessary. With these tools, we hope to make that process as beneficial as possible and help our clients know both their customers and their countries.

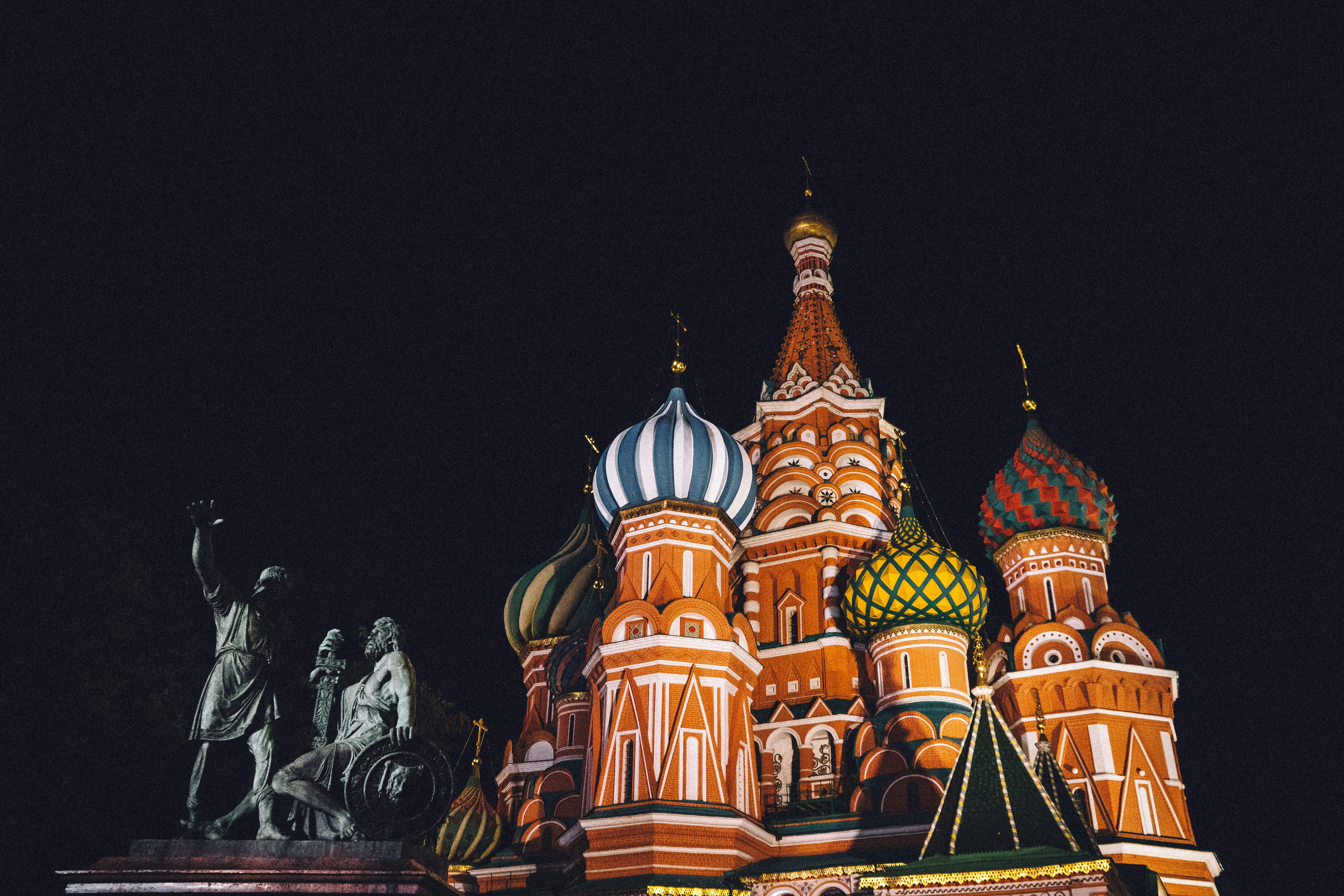

On March 9, 2024 the Russian Elites, Proxies, and Oligarchs (REPO) Task Force released a general update and an advisory to contribute to effective...

In June 2025, the U.S. Treasury dropped a seismic blow on Mexico’s financial sector by sanctioning three of its banks, CIBanco, Intercam Banco, and ...

In 2025, the U.S. government designated Latin American cartels as Foreign Terrorist Organizations (FTOs). The move rewired the global risk landscape...