On pushing forward broader adoption

As we build deep, autonomous risk data linkages on financial institutions and corporates around the world, we are constantly tracking new trends (and their adoption). While our focus is on EMEIA and LATAM, it is interesting to note that it took looking at almost a thousand banks to find the first fully complete Wolfsberg Questionnaire.

Why is this important?

For one, none of them were in emerging or frontier markets.

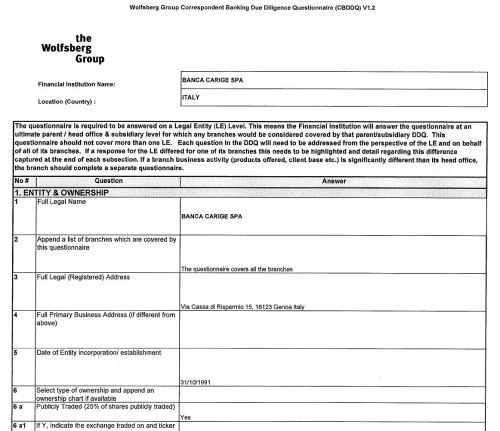

No, the first example we found is for a mid-tier bank in Italy called Banca Carige. Specifically, Banca Carige’s report is the first found that has both: i) updated 2018 information; AND ii) a fully populated new Wolfsberg Report.

Nice job. However, before celebrating, please note that Banca Carige’s report is the exception and not the rule in Italy.

At Sigma Ratings, we supported the development of the new Wolfsberg format and have subsequently integrated it into our model. Wider scale adoption not only helps increase transparency, but it helps build deeper trust and understanding of risks and control environments at scale.

The Anti-Money Laundering (AML) legislation is enacted with the aim of the detection and prevention of any illegal activity concerning finance,...

While KYC stands for “Know Your Customer” and is at the heart of AML efforts, for compliance teams it can be just as important to “Know Your Country”...

Why Sigma Ratings?