What you should be paying attention to in 2021:

For ease of reading, we divide predictions between highly probable, probable and possible. They are meant to be thought-provoking more than anything. They may not happen, but may be useful as a discussion point at your next compliance meeting or in your next risk assessment.

Highly Probable:

-

The pace of technology/analytics innovation in the fight against financial crime will continue to quickly ramp up through new approaches and investment - a welcome prediction as 85% of FCC operations today remain administrative and non-analytical in character (according to McKinsey & Co.). The world has changed, financial services are increasingly digital and the cost of compliance must come down in a low interest environment. Adopting technology that really works is the best opportunity to address these challenges and make a dent in the financial crime landscape.

- Among the areas most ripe for AI augmentation are investigations, given the manual approaches taken by most firms today. While we are biased here, as this is one of Sigma’s proven niches, we believe that AI augmentation in the investigation process is a gamechanger at the point of transaction, at the triage stage and at the investigative stage itself. Across this continuum, high quality data and associated scoring can deliver incredible efficiency gains.

- Continued and increasing unrest globally will be exacerbated by lingering COVID-19 and concerns surrounding general inequality. We will not fully know the damage COVID-19 has presented for some time, but early indications around PPP fraud in the United States are a clear harbinger. How this looks globally remains a mystery, but is expected to be big and go on for years as litigation and investigative efforts get underway.

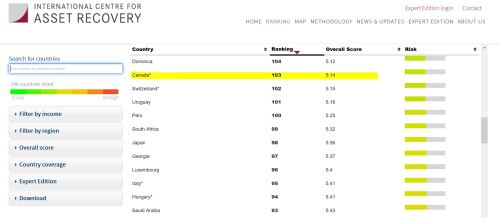

- Illicit actors who previously utilized U.S. shell companies will target other jurisdictions that are less stringent. The complication and level of effort to cover one’s tracks (e.g., legal vehicles referenced in Billion Dollar Whale and 1MDB) are increasing and will evolve. See this post in a blog monitored by Sigma.

- Europe will continue its work to make progress on AML, however, it will remain disjointed and the Euro will increasingly be used to skirt US sanctions and to launder money. For years, those seeking to avoid U.S. scrutiny have turned to the Euro, as it presents less scrutiny and legal risk than moving dollars. Europe certainly recognizes this and now must act.

- Increasing geopolitical tensions between the United States and Iran, North Korea, Venezuela. China to factor into this calculation as it continues to develop its own “sanctions-concept” as forecasted here last year and the year before. The most interesting phone call of 2021 will be the first one between President Biden and Xi Jinping.

- Crypto is here to stay. Bitcoin to $100k? Regardless one’s speculation, the onramps and offramps of crypto have never been more available. This is true for both institutional and retail purchasers. The rise of crypto will result in additional regulation, not to mention, concern surrounding its intersection with illicit finance.

Probable:

- Without face-to-face meetings on a global scale until late in 2021 we see more emphasis on KYE (Know Your Everything). This is likely a permanent change to know more - using data and analytics - around suppliers and customers’ customers (particularly in trade finance, correspondent banking, etc.). Luckily, we make this easy with our risk scoring API.

- Further focus on the “G” in the ESG realm, as well as credit analysis more broadly. The rise of governance failures and the importance investors are now placing on ESG factors to drive greater transparency and awareness - including metrics that extend beyond board diversity and comp. The sheer size of some of the issues - particularly where firms fail as a result of good governance - are increasingly on the minds of credit rating agencies. With this in mind, see our joint research with Fitch Ratings on this subject here.

- We also see further recognition (and shifting of spend to represent it) that list-based screening is not enough. The total entities and names associated with list-based screening are only a few million. Do we really believe that represents the true risk facing businesses today? The answer, of course, is no.

- While historically hesitant, we see regulators increasingly leaning in to encourage technology adoption in the fight against financial crime - to include how information is shared, mined and actioned. The recent request for comment from FinCEN and others suggests a willingness to change and focus on effectiveness. We expect more of this going forward. In the end, the effectiveness of the AML regime is ultimately correlated with the usefulness of its results to law enforcement and impact on the risk calculation of a bad actor.

- Better funding and staffing levels in the United States Justice Department of elements of Treasury will lead to more scrutiny and enforcement. The combination of funding and staffing, as well as the utilization of technology to make these organizations more effective on AML and anti-corruption work globally.

- A complete review of Trump-era sanctions. Did they make sense, are they clear enough and do they serve the best interest of the United States and its allies?

Possible:

- With COVID-19 as an accelerant, banks begin to experiment and push forward dynamic customer due diligence with more urgency. The concept of dynamic customer due diligence was a hot topic in 2020, but implementing it and sourcing the data necessary - both structured and unstructured - is more challenging than it appears on the surface, not to mention managing what will likely be an increase in triggers to work (including those that are false positives).

Look Back on 2020’s Predictions:

While broad, we nailed a number of things that we saw coming in 2020 in the risk and compliance space.

- We predicted that OFAC would become significantly more active as the Trump Administration turned to sanctions. We were right here and as you can see in the chart below, the number of sanctions-added outpaced every administration prior to Trump’s.

- Similarly, we predicted increasing hostility to U.S. markets for firms that might pose national security threats. The ramp up of the Commerce Department’s list of companies - particularly those associated with Russia and China - prove out this point.

- We predicted blockchain would fade as the hot topic. And while that seems largely to be true, the rise of cryptocurrency and the price associated with Bitcoin, Ethereum, etc. are at all time highs (with no signs abating). Interestingly, the hype has not caught up with the price (at least not yet).

- We predicted increasing recognition around the limitations of AI. This is a tricky one. The point being AI - while powerful - has limitations and the disconnect between executive expectation and reality are not fully realized. What seems to be better understood is that AI and programmatic approaches to risk management (RPA) can assist - or augment - good analysts and make them more efficient and effective. Not to mention save money.

- We predicted European progress would be made on AML, but also predicted it would lag expectations. It is 2021 and we have the beginnings of a plan to bring unity to the continent’s approach. For example, a common rule-book and intelligence sharing are good steps forward and absolutely necessary to make a dent in money laundering itself.

- We called attention to an increasing focus in the “G” in ESG as something to focus in on. And breaking news on the likes of Wirecard and others further highlighted the need for more work in that space - particularly given the clear warning signs that existed prior to the firm’s collapse juxtaposed with the relatively high “G” rating had from industry data providers.

What we got wrong in 2020

We actually were more right than wrong, however, we missed some things that probably should have been included. Here are a few:

- Perhaps the biggest is the United States’ work to push forward legislation on Ultimate Beneficial Ownership. It is a landmark development, as criminals will have a harder time hiding behind shell companies - at least in the United States and factors into our predictions for 2021.

- While it could not have been predicted, the FinCEN Files leak again put the financial crime discussion front-and-center. What it illustrated, as much as anything, is the extent to which individuals will go to structure and move money globally. It also provided an opportunity for FinCEN to request comments on how we further revolutionize our efforts to combat money laundering with the goal of making the AML regime more effective.