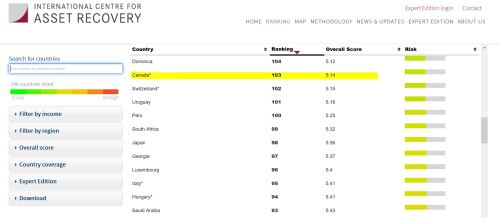

This week, the Basel Institute on Governance published the 10th annual edition of the Basel AML Index for 2021, a country risk ranking of money laundering and terrorist financing risks across jurisdictions. Notably, this year’s edition saw Andorra end Estonia’s years-long run as the world’s least risky jurisdiction, with the institute excluding Estonia and other jurisdictions due to a lack of 4th-round FATF evaluation, including Afghanistan which was replaced by Haiti as the world’s riskiest jurisdiction.

Overall, the average global AML risk increased (from 5.22 to 5.3 out of 10) across all jurisdictions accessed in 2021 with the Basel Institute highlighting “four areas of AML/CFT policy that urgently need more attention.”

According to the Basel Institute, even “among jurisdictions whose risk scores improved this year, none managed to improve by even one point out of 10 [and] half of improvements were 0.3 of a point or less.” The four key areas holding jurisdictions back in their fight against illicit finance, according to the institute include:

With the increase in the average global AML risk in 2021, the Basel Institute anticipates that “average performance will [further] decrease if the FATF strengthens its requirements” following its public consultation this year on potential amendments to Recommendation 24, which relates to the transparency and beneficial ownership of legal persons. Following the FATF revision of Recommendation 15 on virtual assets in June 2019, of the 27 jurisdictions assessed or reassessed for technical compliance this far, more than two-thirds saw their scores downgraded with only three jurisdictions managing to improve their score. Yet, approximately 100 jurisdictions have not been assessed for compliance with the revised recommendation, and with the FATF constituting a significant portion of standard country risk ratings, institutions may not have an accurate view of country risk, a critical factor in assessing customer and transactional risk, especially when refreshed on an annual basis. This was highlighted by Sigma following the release of the 2020 Index which saw Malta go from one of the lowest risk jurisdictions in the world to the highest risk jurisdiction within the EU in under 12 months, underscoring the need for a more dynamic and holistic view of risk given the rapidly changing environment we find ourselves in 2021.

Sigma Ratings is thrilled to have been named the Best Data Analysis Tool at the 6th Annual Benzinga Global Fintech Awards this week and “recognized...

Last week theWall Street Journalhighlighted a new, burgeoning money laundering hub.Where is it you ask?

For years shell companies have been at the heart of both legitimate business activity and money laundering schemes. The Financial Crimes Enforcement...