Last week the Wall Street Journal highlighted a new, burgeoning money laundering hub.

Where is it you ask?

Well, one might slip into “group think” and assume the hub is a far-flung emerging market that failed a Financial Action Task Force (FATF) effectiveness exam or recently confiscated the yacht and Rolex collection of a shamed Prime Minister.

That assumption is flat wrong.

The hub in question is … Canada. Yes, that G20/G7 country in North America.

The Journal article shines a well-researched light on the sheer magnitude of the problem facing global bankers, regulators, and other stakeholders. The problem is this: If Canada is facing complications tackling AML challenges, what are we to deduce about the reality on the ground in countries with less resources?

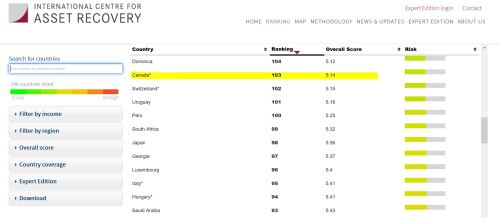

To illustrate further, the Basel AML Index, run by the International Centre for Asset Recovery, and relied upon by a number of banks for country risk scoring, lists Canada as relatively low risk. The Basel AML Index model also, interestingly, lists Estonia among the safest countries in the world (Note: Estonia is in the eye of an AML superstorm connected to the Danske Bank case).

An informal - and unscientific - review of banking and corporate contacts reveals that less than 5% have both Canada AND Estonia internally as medium risk or above (though this is probably changing).

These revelations highlight two key points that underpin our thesis at Sigma Ratings

To address these two points, we have built what we believe is an incredibly durable and robust country risk model and used that to underpin a growing database of entity risk scores.

Where can you get it? Well, after testing it with 10 of the world’s largest global banks and a number of regulators, we are adding features, coverage and further dynamism.

This week, the Basel Institute on Governance published the 10th annual edition of the Basel AML Index for 2021, a country risk ranking of money...

For years shell companies have been at the heart of both legitimate business activity and money laundering schemes. The Financial Crimes Enforcement...

Last week, the Basel Institute on Governance released its 2020 edition of the Basel AML Index. And what a surprise it was to discover that the...