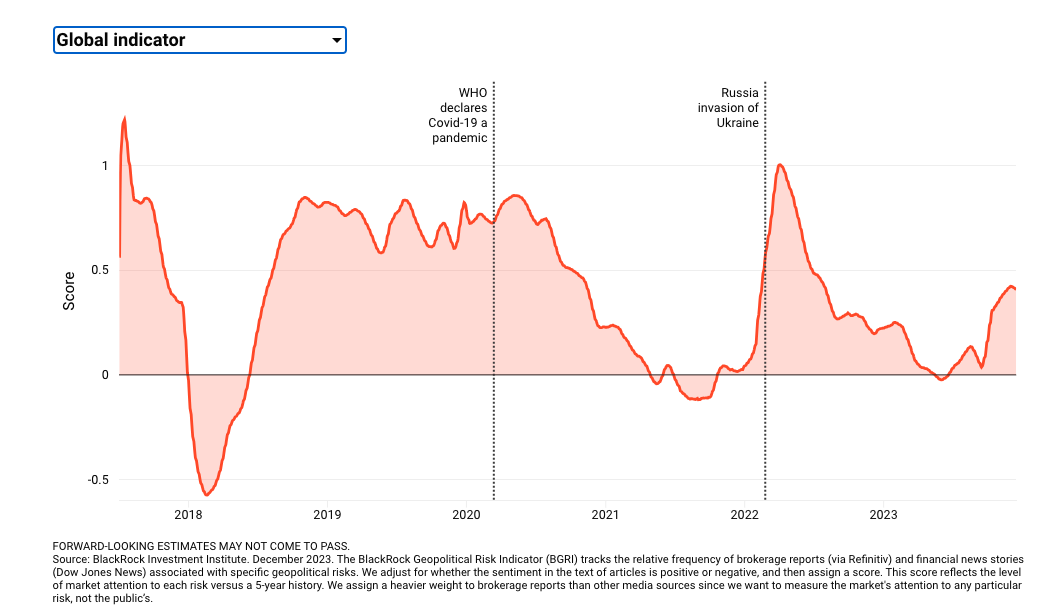

Risk managers faced significant challenges in 2023 and also experimented more deeply with the promise of technology to keep up and stay ahead in an ever changing world. The world went from one hot war, to two and with that came rising geopolitical risk and regulatory pressure that now entraps global shipping, energy stability and finance, ultimately challenging traditional approaches to risk management. 2024 will be another pivotal year.

Image: Blackrock Geopolitical Risk Dashboard

Sigma360 Annual Risk Predictions

Sigma360’s clients, ranging from global corporations to leading fintechs to systemically significant financial institutions, require accurate, fast and always-on risk management software that can help them comply with mission critical regulatory requirements, and at the same time, position to evaluate emerging risk and interconnected issues. Our clients represent over $1.5 trillion in assets and company value, are globally dispersed and act as partners in our product evolution given their unique vantage points on the market.

These truths inform our view of what’s to come in 2024, and in many ways, are an extension of what we said in 2023 (most of which has played out much like we imagined).

Our founder, Stuart Jones, Jr. sat down with Karim Rajwani, a former risk executive at the world’s largest financial institutions and current Chief Product Officer at Sigma360 to posit what’s next.

As always, our predictions for the new year are best used as discussion points at a risk committee, for broader knowledge and future organizational planning. How your organization will contend with the challenges of tomorrow are best discussed today and the following observations can only help in that effort.

7 Trends and Predictions for 2024

1. Global conflict will continue to deepen, pressuring leadership and risk managers to further adapt their operations to ensure their organization is on the front foot.

“Near-daily sanction announcements, increasing obligations to evaluate supply chain risks and a re-focus on terrorist financing necessitates modern, future-proofed approaches that marry world-class technology and data,” said Stuart Jones, Jr, CEO of Sigma360 and a former senior official with the U.S. Treasury Department. “These needs are likely to only increase over the next twelve month as the international response to growing conflict strengthens.

“In addition, we will continue to see sanctions by China, Russia and other countries often conflicting with each other. Organizations will need to walk the increasingly thin tightrope of balancing profitability versus risks”, said Karim Rajwani, Chief Product Officer and Advisor to Sigma360.

2. Compliance costs will increase, however, institutions who start to meaningfully shift their thinking now and embrace emerging technologies, further automation and modern workflows will be better positioned to manage these new realities over-time.

“Firms are cost conscious, but are increasingly focused on finding innovative ways to both meet regulatory expectations and achieve effectiveness-oriented outcomes,” said Jones. “This is largely being driven by increasing regulations for banks and everyone else, a clear recognition of the impact that reputational issues can have on a business and shareholder and board pressure to be on the right side of risk and avoid surprises."

“There is a need and a desire to get better, smarter and more efficient in identifying true risks and reducing noise. This is becoming increasingly difficult as criminals are getting more sophisticated and taking advantage of shell companies, crypto and other conduits to launder their proceeds,” said Rajwani. “A greater investment will be made by vendors and institutions in artificial intelligence (AI) to achieve the goal of getting better at identifying real risk and reducing noise. AI has demonstrated some initial successes but the adoption rates are slower than expected. However, this is rapidly changing, and is at the same time introducing new risks such as bias and discrimination. Policy makers globally are already issuing laws and guidance to minimize the risk of misuse. We can expect to see more of this which in turns means incorporating these important checks and balances into an organization risk management program.”

3. Traditional data silos further converge and help drive a better understanding of one’s clients which helps mitigate risk, move to dynamic monitoring versus periodic reviews and improve service levels.

“We are seeing institutions cross-share data that has traditionally been the domain of credit teams and fraud teams to get ahead of fraud and possible default. Leveraging a range of data, including global news and event detection, corporate ownership and other sources of information is driving better, more contextualized decision making and customer understanding,” said Jones. “More and more clients want to know how to ‘get ahead of risk’ and are partnering to leverage advanced adverse media capabilities, graph and vector databases and other approaches to achieve a more equipped and informed posture.”

“As technological capabilities improve and become more affordable we can see greater adoption across the industry, not just the large financial institutions,” said Rajwani.

4. Watchlist screening is the law, but increasingly isn’t enough. Institutions and globally exposed companies will need to start to address this with additional data and more advanced software capabilities.

“Since our founding, we have pioneered and advocated for ‘beyond watchlist capabilities’, especially across certain business lines and customer risk profiles (on the back of decades of enforcement actions specific to this). This concept is now going mainstream (and was referenced by many senior regulators at the recent ABA conference in Washington, D.C. in November 2023). This new reality was further bright-lined throughout the year as Treasury and aligned nations sought to isolate both direct targets and networks/enablers from Russia to Hamas,” said Jones.

“Sophisticated money laundering, tax and sanctions evasion requires an understanding of proximity or association risk, without that insight firms are operating in the “check-the-box” compliance environment, which will not be tolerated,” said Rajwani.

5. Fraud will continue to grow and morph as technology becomes more advanced and available globally.

“New technology allows organized crime gangs in a country to target victims using various schemes such as advanced fee fraud, cyber fraud, account takeover, authorized push payment fraud. The line between organized criminals and state actors is becoming increasingly gray, particularly around ransomware,” said Rajwani. The push to have 2 factor authentication, one time passcodes and payment systems rules is helping but the onslaught continues. In a recent report by UK Finance, more than 75% of the fraud in the UK came from foreign online sources, so banks, technology companies, Fintechs and payment processors need to partner together to stem the tide.

6. Greater push for ESG and social responsibility.

We have already seen the convergence of fraud, human trafficking and organized crime in recent “pig-butchering” cases. At the same time the industry and regulators have responded with a greater focus to fight human and wild-life trafficking, labor trafficking (which is increasingly being integrated into sanctions regimes) and child sexual exploitation,” said Rajwani. Human trafficking and Child Exploitation are growing at an exponential rate and have become one of the largest criminal activities. We have already seen this become a priority for FINCEN and other regulators. Similarly, various policymakers have issued new regulations on online safety to protect children, including the UK and Australia. We will continue to see the push for social media and technology companies to take more responsibility.”

“You can’t have ESG without good governance and that includes putting in place a robust financial crime and sanctions program,” said Jones. “An increasing number of financial institutions and corporates are making this link. It is also manifesting in private equity, as available investment dollars prefer companies who take these risks seriously.”

7. The new year promises significant change, particularly in terms of the regulatory agenda. This is particularly true in the United States.

“In 2024 we will see the implementation of the Corporate Transparency Act and serious work to bring forward further controls across a range of other industries from real-estate, to private equity to art and antiquities,” said Jones. “There is a realization at the Treasury Department and other areas of the government that significant gaps remain in the United States’ AML regime. Moreover, with industry feedback, we anticipate a revision of FinCEN’s National AML Priorities and additional focus at the national and state level surrounding foreign land ownership by ITAR countries."

How can Sigma360 help me stay ahead?

Using Sigma360's risk decisioning software platform, organizations can not only get ahead of risk, but leverage unstructured data - like the news highlighted in this article - to further contextualize its impact and how it manifests across other entities that may impact counterparty relationships.

In today’s fast-paced and highly regulated world, businesses can’t afford to wait for risks to materialize. Compliance and operations teams are...

Knowing your clients and knowing your risk go hand-in-hand.

On November 21, 2024, the U.S. Treasury Department escalated its sanctions compliance efforts by targeting Gazprombank and several smaller Russian...