Global Finance Magazine's July/August 2018 issue featuring Sigma Ratings as a New York–based start-up set to disrupt the risk analysis space with the addition of non-credit risk ratings focused on transparency, corruption risk and money laundering, powered by artificial intelligence (AI).

The article discusses how Sigma uses artificial intelligence to analyze banks' financial data and provide ratings that are more accurate and transparent than traditional credit ratings.

As well as how how Sigma's system is based on machine learning algorithms that are trained on a wide range of data sources, including financial statements, news articles, and social media activity. The system then uses this data to generate ratings that are more comprehensive and up-to-date than traditional credit ratings, which are often based on outdated or incomplete information.

Read interviews with several experts in the field of finance and technology, who offer their insights on the potential impact of Sigma's system on the financial industry and get more detailed information direct from Global Finance Magazine by reading the full article.

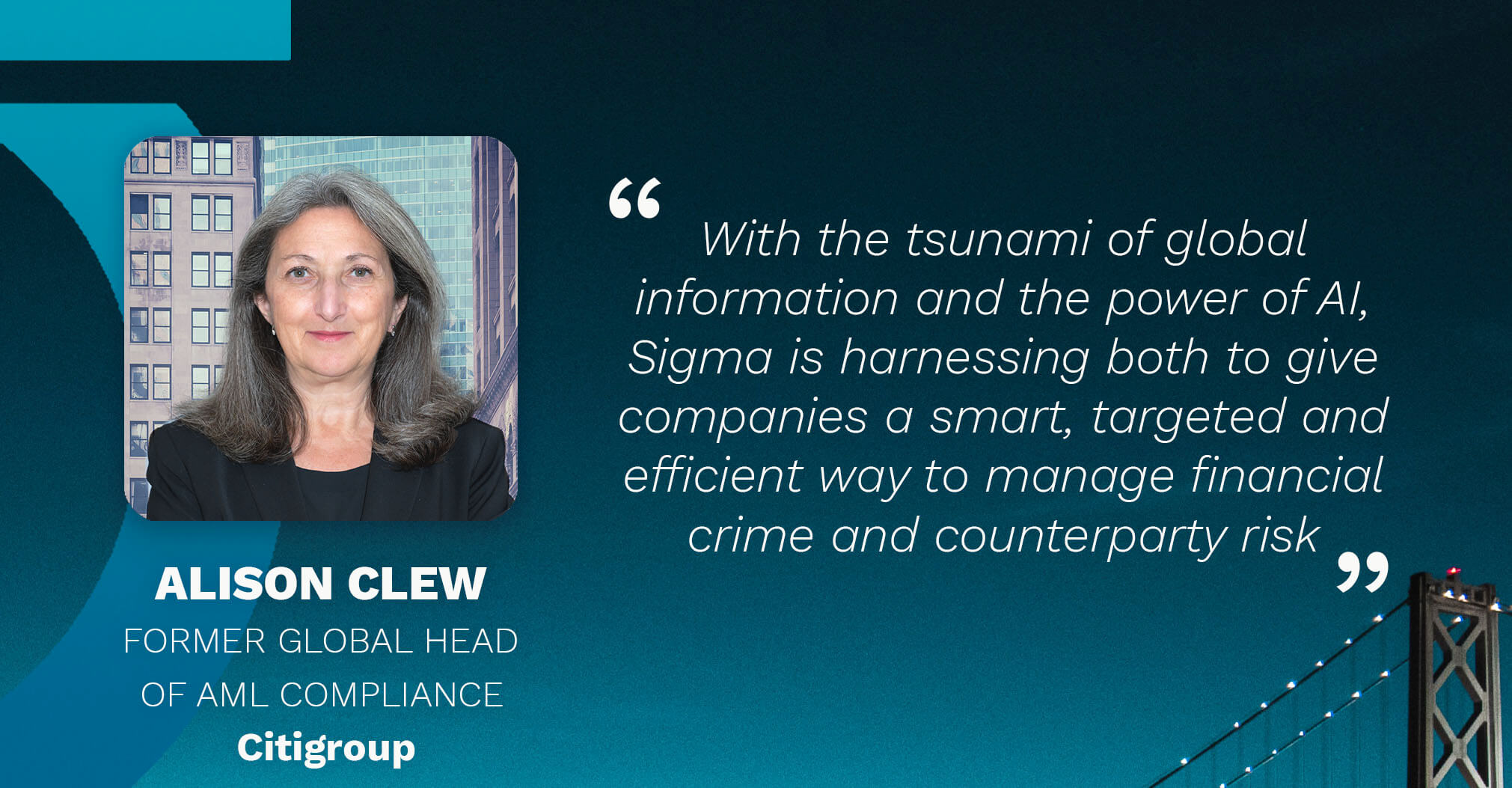

Renowned global risk and compliance expert, Alison Clew, joins AI-driven risk intelligence company Sigma Ratings as a Board member to advise and...

As featured in Euromoney - Sigma Ratings, which is due to go live later this year, will use artificial intelligence (AI) to produce country and...

The latest episode of The National's Business Extra podcast explores the challenges of assessing risk in an increasingly complex world.