This month, a new report titled the ‘True Cost of Financial Crime Compliance Global Report’ revealed that financial institutions spent $213.9 billion annually on financial crime compliance (“FCC”) worldwide, rising 18% in 2020, as institutions tackled increased volumes and risks during the pandemic. Notably, while in years past, there has been a consensus on the top two or three challenges facing compliance functions, the report suggests there is “less uniformity” in this year’s survey.

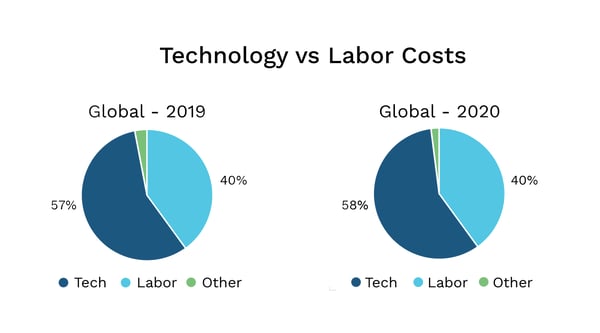

According to the report, respondents found, across the wide spectrum of due diligence, “customer risk profiling, sanctions screening, regulatory reporting, identifying politically exposed persons (PEPs), KYC for account onboarding and efficient alerts resolution all similarly ranked as key challenges,” unlike previous years. The ongoing pandemic, according to respondents, has left a “significant imprint” on compliance functions, which “exacerbated existing issues and led to an increase in the time and spending needed for due diligence.” While the average annual cost per institution has “increased significantly,” the report did find that the distribution of average annual FCC costs has shifted more towards labor.

Charts by lexisnexis.com

Yet, the research also found that institutions that utilized technology to support financial crime compliance efforts have been “more prepared and less impacted overall by increasing regulatory pressures and COVID-19.” Compared to institutions that allocated more of their annual FCC costs to labor, those that allocated more spend towards technology are “seeing smaller year-on-year financial crime compliance operations cost increases, lower costs per full-time employee and fewer pandemic-related challenges.” An overwhelming majority of respondents expect further increases to FCC costs over the next 12 to 24 months due to the pandemic. This, combined with increased regulatory demands such as those announced this week in the UAE, the time is ripe to embrace technology, not only to lessen FCC labor expenditure, but to ensure a strong compliance culture and be better prepared for future unforeseen challenges amid increasing regulatory scrutiny.

This week, the Tax Justice Network (“TJN”) released the 2022 Financial Secrecy Index, which ranks jurisdictions according to “their secrecy and the...

Last week, the Consumer Financial Protection Bureau (CFPB) announced that it will start using a largely unused legal provision to examine nonbank...

This week, the Association of Certified Anti-Money Laundering Specialists (ACAMS) released a report outlining the key steps to improve financial...