The New Standard in KYC and Financial Crime Compliance Automation

AI-powered risk management software that helps teams make more informed risk decisions, meet regulatory expectations, and accelerate workflows at scale

Trusted Worldwide

Why Sigma360?

Built for compliance teams that demand transparency, adaptability and support.

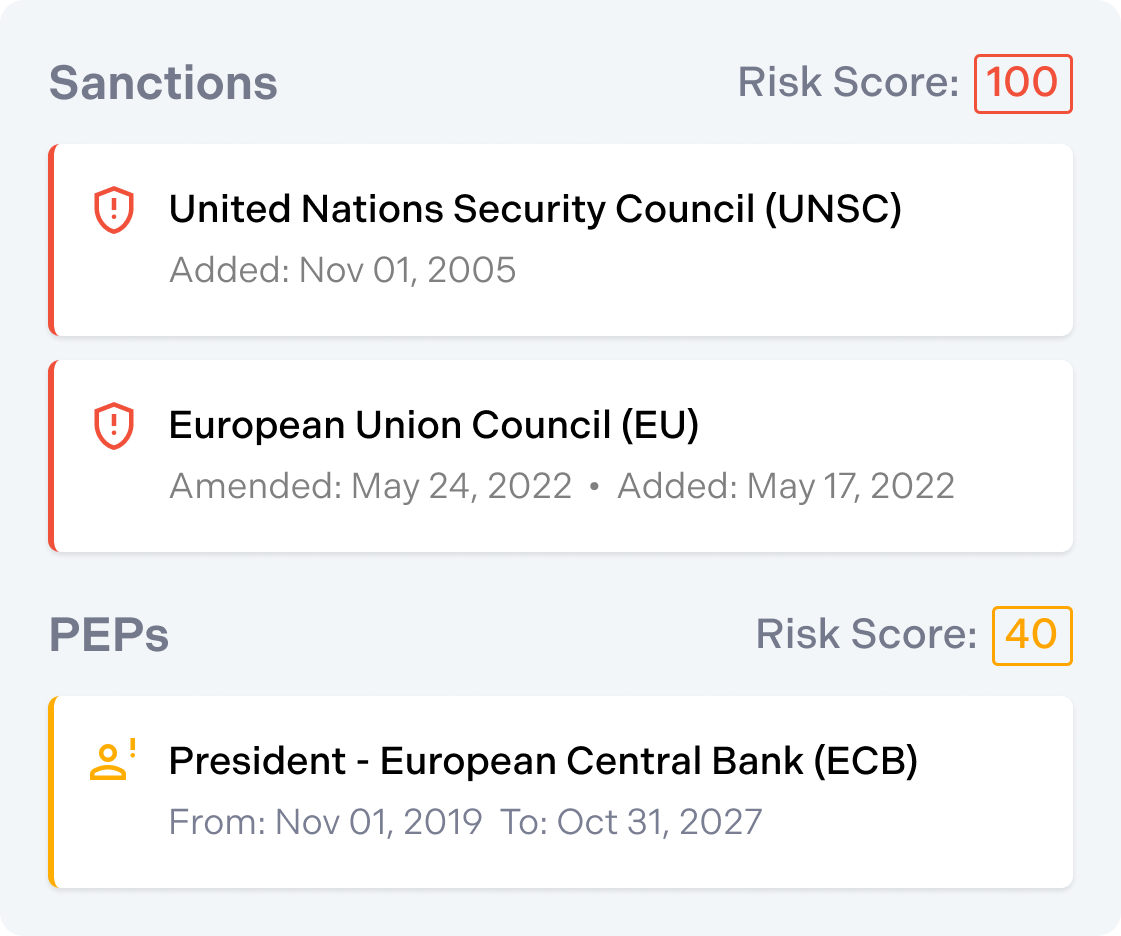

Comprehensive Risk Coverage

Unify sanctions, watchlists, adverse media, PEPs, and enforcement data into one platform for full-spectrum threat detection.

Exclusive Threat Intelligence

Tap into agency-sourced and investigative datasets you simply can’t get from any other vendor.

Unrivaled Accuracy

Cut false positives with industry-leading matching, entity resolution, and scoring built for speed and scale.

Automation on Demand

Automate high-effort compliance workflows on day one with ready-to-use AI-powered tools.

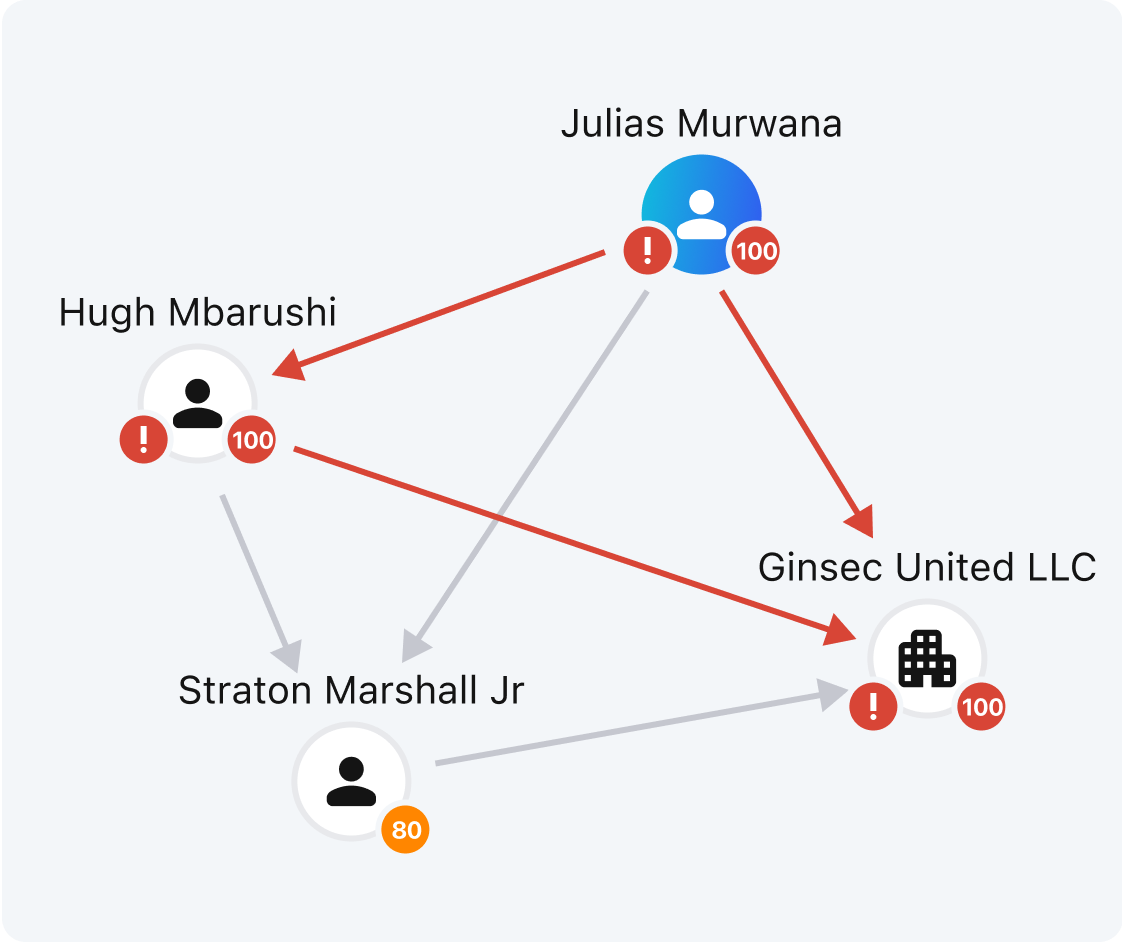

Proactively detect risks and scale with confidence

Sigma360's AI-powered, always-on risk intelligence scales with your business, transforming vast data streams into precise, actionable risk signals. Eliminate critical threats before they become regulatory or reputational liabilities.

100B+

Data Points Analyzed

Unmatched accuracy & depth for strategic decision-making

93%

Reduction in False Positives

Improves accuracy and saves time to case resolution

150+

Corporate Registries

From startups to Fortune 500 companies across industries

24/7

Real-Time Alerts

Always-on screening flags risk the moment it emerges, so you can act before it escalates

Enterprise Solutions

Engineered for flexibility and powered by AI, Sigma360 solutions optimize workflows, improve decision-making, and ensure your team stays ahead of evolving risks—with less friction and greater reliability.

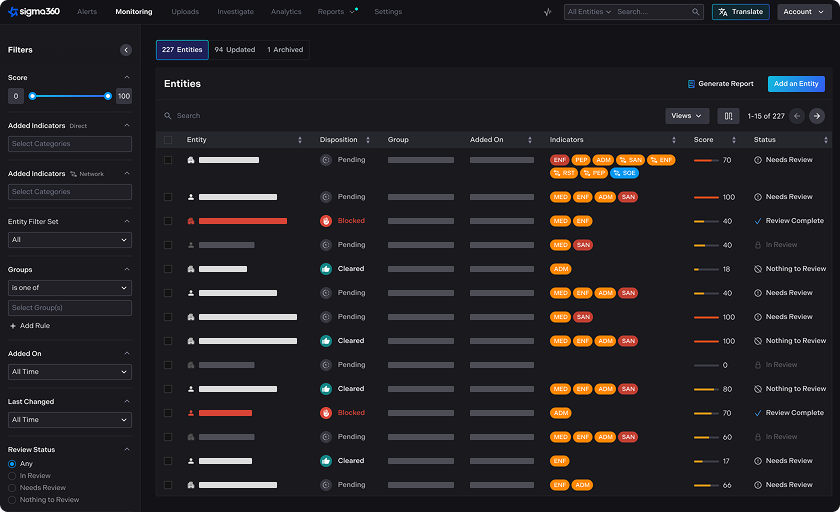

Sanctions & Watchlist Screening

Efficiently screen clients and counterparties against global government watchlists to ensure compliance and mitigate risks.

AML Investigations

Streamline Anti-Money Laundering investigations with advanced analytics to detect and prevent illicit financial activities.

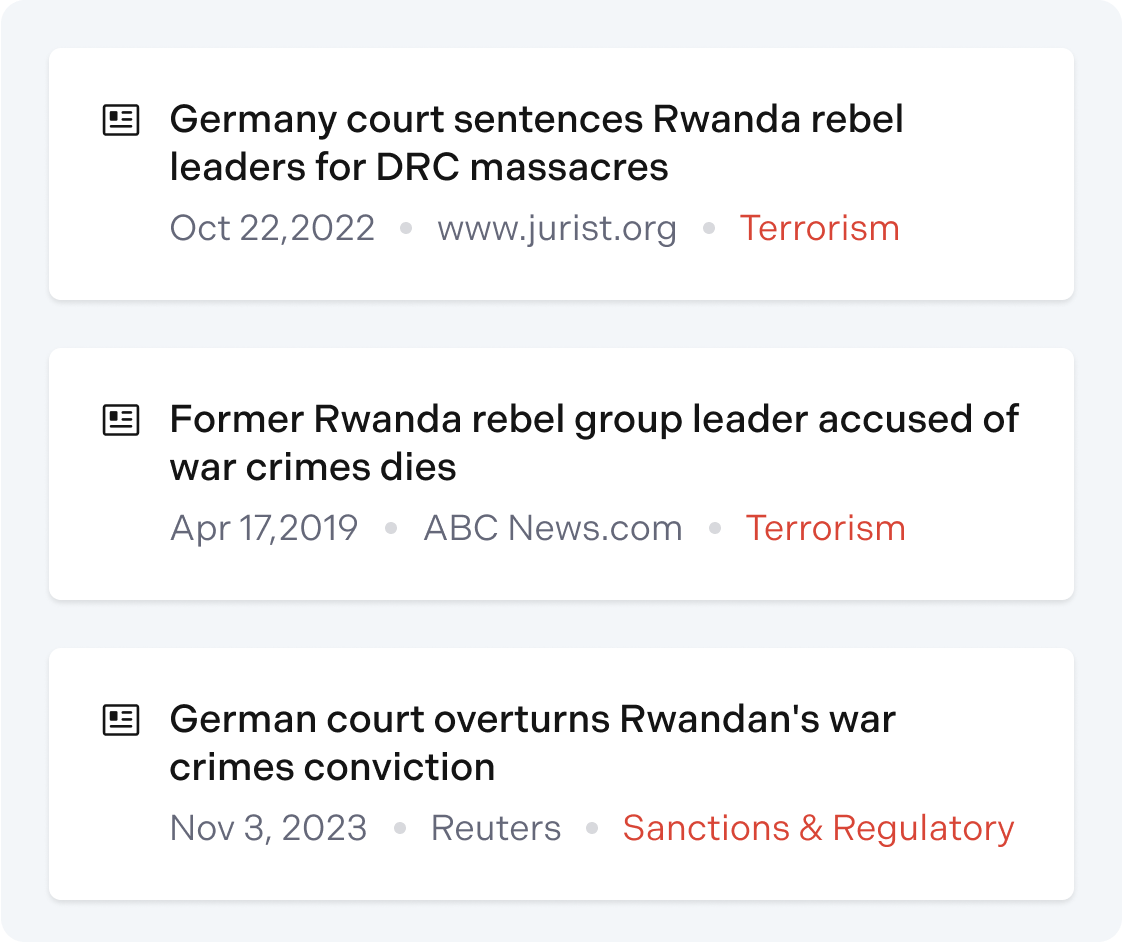

Adverse Media Screening

Monitor global news sources to detect negative media coverage related to your clients and partners, safeguarding your reputation.

Try Sigma360 Risk-Free

Start an immediate, no-risk free trial of Sigma360 today. Just a short onboarding session, then hands-on access to the platform.

Complete risk intelligence with deep visibility and regulatory expertise

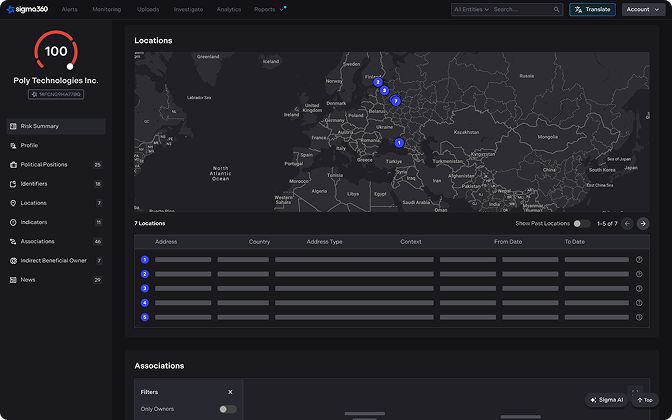

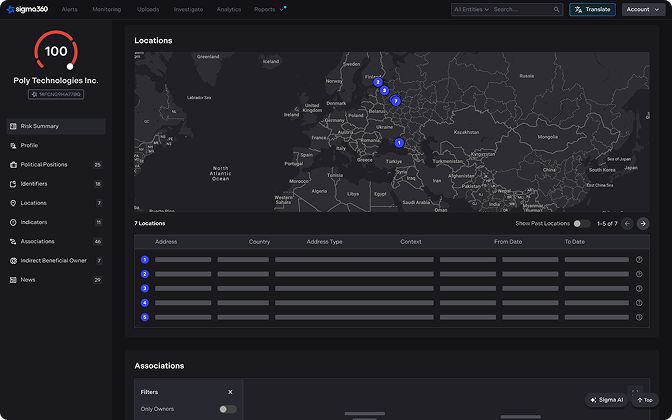

360° risk view with intuitive dashboards

Access a complete view of risk including media, sanctions, PEPs and more through real-time data visualizations and customizable views, enabling your team to act with confidence.

Customizable for your needs

Focus on critical threats. Our customizable platform uses contextual risk scoring and intelligent filtering to surface high-impact events, reducing alert noise up to 93%.

Dedicated success partners

From implementation to daily operations, our dedicated team moves at your speed. We provide personalized training and industry expertise that understands your business inside out.

Scale and adapt without limits

Expand confidently with Sigma360. Instantly adjust filters and workflows through simple controls. No coding, no downtime, no limits to your growth.

Regulator-backed innovation

Sigma360 engages in ongoing dialogue with regulators, and their input directly shapes our innovation. Our solution sets the compliance standard with unmatched efficiency and context.

Featured Insights

Engage with us

Our Risk Intelligence Specialists can get you the answers you need.